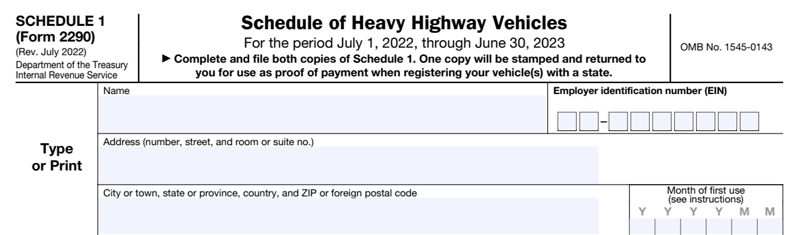

Basic Business Details

The first section of the Form 2290 asks for basic information about your business including Name, EIN, and Address. The second section of the Form 2290 is used to make amendments to an old Form 2290 or to report a final return (if you are getting out of the business, switching trucks, etc.). This section has four different options: