Form 2290 is filed annually to the IRS for the Heavy Vehicle Use Tax (HVUT) by drivers of vehicles weighing 55,000 pounds or more. Filing Form 2290 with ExpressTruckTax is fast and easy because not only does it only take a few minutes, you also have multiple convenient options for paying your Heavy Vehicle Use Tax to the IRS. One of these convenient payment options is to file Form 2290 and select to pay with a check or money order. Below you will find some helpful information about paying your Heavy Vehicle Use Tax using a check or money order.

Writing the Check

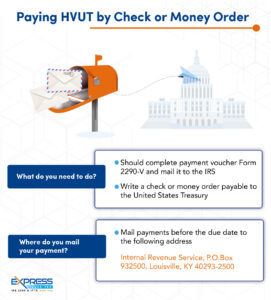

When you select check or money order as your payment method you must make sure you make it payable to the “United States Treasury”. Write your Employer Identification Number (EIN), your phone number, tax year, and “Form 2290” on the check or money order.

What to Include

Upon selecting check or money order, you will receive a voucher, 2290-V, that you will include with your check or money order. Make sure that you do not staple your payment to the voucher. Also, it is important to make sure that you do not include cash with your payment.

Where to Send

The voucher, 2290-V, will contain the address that you will mail your check or money order. This address is as follows:

Internal Revenue Service

P.O. Box 932500

Louisville, KY 40293-2500

Why Pay your HVUT with a Check or Money Order?

Selecting to pay your Heavy Vehicle Use Tax by check or money order means you won’t have to pay your tax right away if you do not have the funds just yet. However, your filing will be considered on time if filed before the deadline. When the money has been withdrawn from your account, you no longer have to worry about your payment being late.

Why File Form 2290 with ExpressTruckTax?

Filing Form 2290 is fast and easy. Simply fill out the information needed about your business, your vehicle, and the credit vehicles you are claiming if any. Paying with check or money order is only one of the several convenient IRS-approved payment methods offered by ExpressTruckTax. All of these are made simple and easy to follow to ensure that your Form 2290 and your Heavy Vehicle Use Tax payment are not late. What are you waiting for? File your ExpressTruckTax now for a convenient and fast Form 2290 filing experience today!