Form 2290 should be filed by drivers of vehicles weighing 55,000 pounds or more annually to the IRS for the Heavy Vehicle Use Tax. It is important to file this form, failing to do so will result in late penalties from the IRS. In order to file Form 2290 you will need to provide specific information for the IRS to know who is filing the form and that the form is being filed for.

What information is needed to file Form 2290?

To file Form 2290 you need to enter your correct business information including your Employer Identification Number (EIN), vehicle information including your Vehicle Identification Number (VIN), credit vehicles you plan to claim if any, and your payment information.

What happens if you enter the wrong information?

When filing Form 2290 it is entirely possible to make a mistake. You may enter the wrong number for your EIN or VIN or even the wrong weight, mileage, or address into the form. If you make any of these mistakes, the process for fixing them depends entirely on the mistake that was made.

Wrong VIN

When the VIN is entered incorrectly, the process for correcting it depends on how many characters the VIN was off by. If the VIN was off by only a few characters, you are able to file a Form 2290 VIN correction amendment in order to correct it. If the entire VIN is wrong, a new Form 2290 needs to be filed and Form 8849 must be filed in order to let the IRS know that the original Form 2290 was not correct and request they move the tax to the new form for the tax paid on the original form. This only applies if they have already paid the taxes.

Wrong Weight class

When the wrong weight class is entered, the process of correcting it will depend on whether the weight was more or less than the actual weight of the vehicle. If the weight was reported as being less than it actually is, a Form 2290 Amendment for weight increase must be filed and then you will pay the rest of the tax amount that is owed. If the weight is actually less than what was originally put on the original Form 2290, you must file a new Form 2290 and then file Form 8849 to request the original tax amount back after paying the new tax amount.

Wrong Mileage

If a qualifying vehicle drives less than 5,000 miles a year or less than 7,500 miles a year if it is used for agricultural purposes, it is considered suspended by the IRS. Form 2290 still needs to be filed in this case but no tax will be owed for this vehicle. If a vehicle is filed as suspended but then exceeds the mileage limit, a Form 2290 Amendment for mileage exceeded must be filed and then the full tax amount for the year must be paid. If Form 2290 was filed as not suspended and the vehicle was actually suspended, Form 8849 must be filed to request the tax amount for that vehicle back to you.

Wrong Address

If the wrong address is put into Form 2290, in order to correct this a new Form 2290 must be filed. Then you must file Form 8849 for this vehicle to request that the original tax amount paid be returned to you.

Wrong business name/name/EIN

If the wrong EIN or business name is entered into Form 2290, a new Form 2290 must be filed and the tax must be paid for the new form. You must then file Form 8849 for this vehicle to request that the original tax amount paid be returned to you.

Why choose ExpressTruckTax?

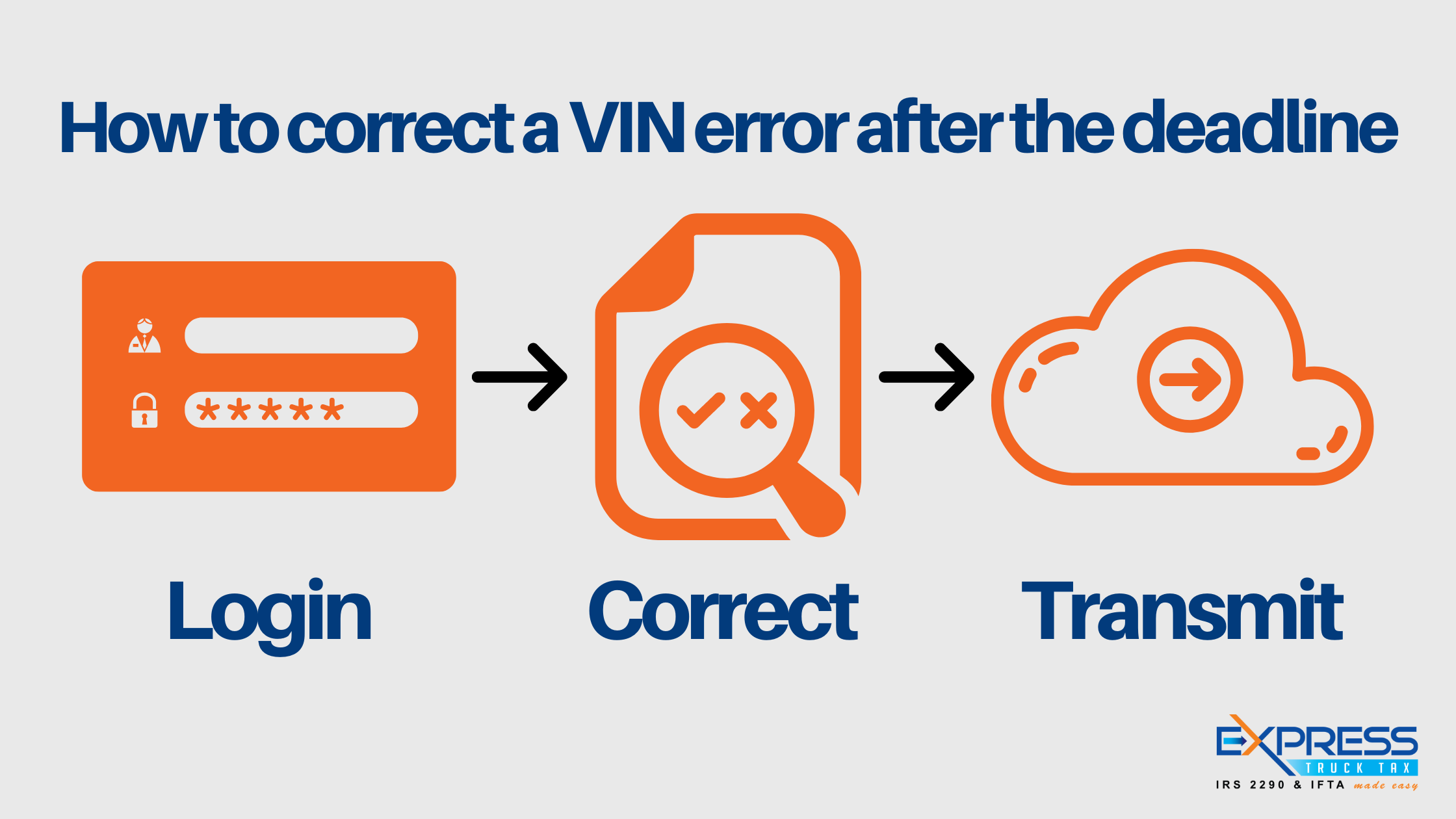

By filing with ExpressTruckTax, all of these corrections are made easy. Simply enter the new information into either the Form 2290 Amendment or Form 8849 that you are filing. Once the information is entered and the filing fee has been paid, you will simply transmit it to the IRS. If you are doing a VIN correction amendment and you filed your original Form 2290 with ExpressTruckTax, the fee for filing this amendment waived. When filing Form 2290 or Form 2290 amendments you will get an updated Stamped Schedule 1 within minutes of the IRS accepting your form. What are you waiting for? Make any corrections to Form 2290 that you need to make with ExpressTruckTax today!