IRS 2290 payment is a vital part of tax season for commercial truckers. Sometimes called the Heavy Highway Vehicle Use Tax, IRS Form 2290 assesses heavy vehicle taxes for vehicles that regularly operate on public highways. It ensures that truckers who regularly use highways within a given year must contribute to their upkeep and maintenance.

IRS Form 2290 payment applies to all highway motor vehicles whose taxable gross weight is at least 55,000 lbs. It must be paid by anyone with such a vehicle registered in their name, whether an individual or organization. Failure to pay the tax can result in penalties of 4.5% of the total amount due or more as time goes on.

IRS Form 2290 Payment: A Detailed Look

If you’re new to the 2290 IRS payment or simply want a refresher, you’ve come to the right place. Below, we’ll go through IRS Form 2290, section by section. To file manually, follow these steps.

- Fill out your name, address, and employer identification number (EIN).

- Check the appropriate box if you’re filing an address change, amended return, VIN correction, or final return.

- Part I Figuring the tax: Start by computing your taxes on Page 2 of the form. Then, fill out Part I.

- a. Line 1 is the month for which you are filing.

- b. Line 2 is the total you reached on Page 2, Column 4.

- c. Line 3 is for any additional taxes due to a change in taxable gross weight. If any of your vehicles fall into a new category due to increased maximum load, instructions for Line 3 are available on the IRS website.

- d. Line 4 is the total tax, found by adding lines 2 and 3.

- e. Line 5 is where you can claim any credits due to you. If doing so, you must attach documentation to support your claim.

- f. Line 6 is the balance due, calculated by subtracting Line 5 from Line 4.

- g. Check the appropriate box on Line 6 stating whether payment is through EFTPS or a credit or debit card.

- Part 2 Statement in Support of Suspension: Check the appropriate boxes if applicable.

- Line 7 claims tax suspension based on the miles your vehicles will travel on public highways during the period.

- Line 8a declares your vehicles are not subject to the tax, except those listed. Line 8b is a space to record the VINs of any vehicles that no longer meet the parameters for suspension. Attach an extra page if needed.

- Line 9 declares any vehicles listed as suspended during the prior year that have since been sold or transferred. Include the details for these vehicles, including VINs, new owners, and date of sale. Again, attach an extra sheet if needed.

- List any third party you want to designate as a contact point for the IRS.

- Sign the form, date it, print your name below your signature, and include your contact phone number.

- The last section is for the use of paid tax professionals. If this is not you, leave this portion of the form blank.

Once you’ve filled out the main form, move on to Schedule 1. There, you’ll fill out your basic information (name, address, EIN), the month of first use, and the VIN and category for each vehicle you’re reporting. Below, list the total number of vehicles reported, the number of vehicles for which this tax is suspended, then subtract suspended vehicles from reported vehicles.

Sign and date Schedule 1 on the page titled “Consent to Disclosure of Tax Information” and include your printed name and EIN. Finally, fill out the payment voucher (Form 2290-V) with details of your payment, detach it, and send it to the IRS along with your IRS gov payments 2290 and documentation.

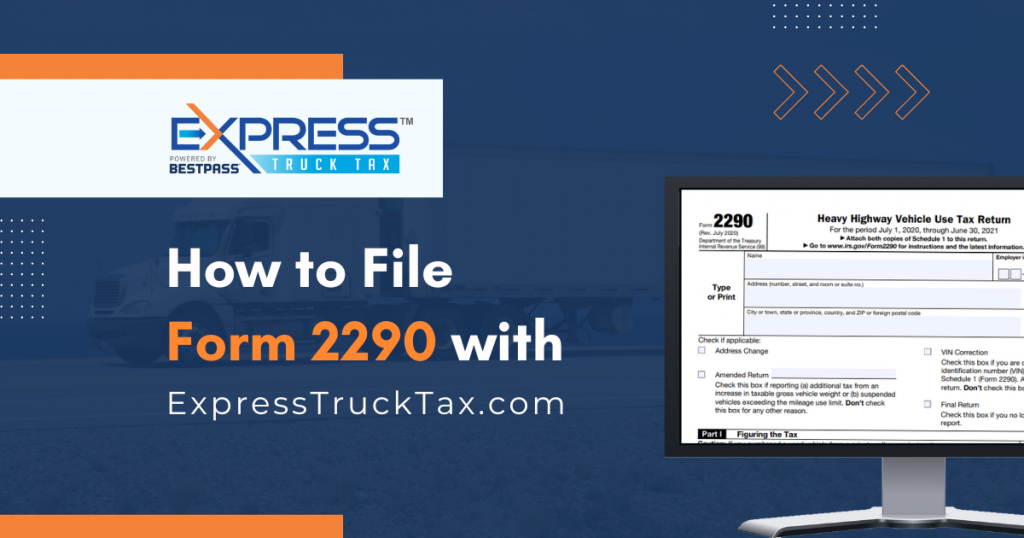

How to Make Your IRS 2290 Online Payment

If the above seems like a lot of work and too much paperwork for you, we have good news: you can also file your IRS 2290 payment online. By doing so, you’ll get your stamped Schedule 1 much quicker, allowing you to register your vehicles without a lengthy wait for the mail.

To file your 2290 IRS payment online, you’ll need to first gather some information. Have your company’s information at hand, including your EIN. Next, gather the information for each of your vehicles including VIN and miles driven.

Next, be sure you have your payment information ready. If you’re filing online, you’ll need to do so with the help of a third party. This means you’ll need to pay your taxes due as well as a small fee for online processing. This fee is typically a small price to pay for faster, simpler tax preparation and a quicker Schedule 1 turnaround time.

When choosing a third party to file your taxes, it’s important to consider the options available. Some offer only the simplest of services, while others offer features that will ensure accurate filing and fast processing. Sites like expresstrucktax.com offer money-back guarantees, a VIN checker, VIN corrections, and full support for any questions or problems you may encounter.

Troubleshooting Your IRS 2290 Payment Online

There are a few common issues you might run into while making your 2290 payment online. These include:

- Employer identification number and business name do not match

- Banking details are entered incorrectly

- Duplicate VINs

- Duplicate Form 2290 online filing

If the IRS rejects your Form 2290 for any reason, you will receive an email explanation of the rejection. This email will also include instructions for correcting your errors. Be sure to make the prescribed corrections efficiently so you don’t incur penalties for late or missed filing.

IRS Gov Payments 2290: Additional Information and Resources

The IRS has a number of helpful resources you can review to ensure you’re correctly filing your truck taxes.

- Form 2290 (Rev. July 2023)

- Form 2290 (Spanish version) (Rev. July 2023)

- Instructions for Form 2290 (07/2023)

- About Form 2290, Heavy Highway Vehicle Use Tax Return

- FAQs for Truckers Who e-file

- Tax Year 2023 2290 Modernized e-File (MeF) Providers

- Internal Revenue Service Trucking Tax Center

FAQs on 2290 IRS Payments

What is the IRS 2290 payment?

IRS Form 2290 is also called the Heavy Highway Vehicle Use Tax. It’s a tax on heavy vehicles that regularly use the nation’s public highways.

How to make the IRS 2290 payment online?

To pay your Form 2290 taxes online, you’ll need an intermediary. Select a site such as ExpressTruckTax to help you with your filing. Through such sites, you can typically pay your taxes via credit card, debit card, or electronic funds transfer.

Why is the IRS 2290 payment necessary?

Anyone regularly operating a heavy vehicle (of at least 55,000 lbs.) on US highways must file IRS Form 2290. Once the form is accepted by the IRS, you’ll receive the stamped Schedule 1 you’ll need to register your vehicles in most states. Failure to file means hefty penalties of 4.5% of the amount due and more as time goes on.

Who should make the IRS 2290 payment?

Any individual or company who has a heavy vehicle (weighing 55,000 lbs. or more) that regularly drives on public highways registered in their name must file an IRS Form 2290.

How to troubleshoot issues with the IRS 2290 online payment?

If there are any problems with your IRS Form 2290, you’ll receive an email from the IRS stating that it has been rejected and why. This email will also give you instructions on how to remedy the problems so that you can refile your Form 2290.