|

| Correcting a 2290: Part 1 – VIN Corrections |

So you e-filed your HVUT 2290, but realize you made an error on your VIN, yet the IRS accepted it

anyway. What do you do?

Well, if you e-filed with us, you can just login and e-file one of the Form 2290 Amendments we offer – specifically, the free VIN correction!

Since filing season has come and gone, we decided that we’re going to spend the rest of the month focusing on a favorite subject of ours: HVUT amendments and corrections!

We know mistakes happen, and that includes mistakes on the IRS Form 2290. With our free VIN correction option, you won’t have to worry about it anymore. We also offer VIN corrections at a small cost, no matter who you filed with. What we’re saying is, we have you covered!

So how do you e-file a VIN correction?

VIN Correction Made Easy

It’s pretty simple, you just start at the dashboard (after signing in) like always, and then select Start New Return.

You’ll be promoted with a few options – just press Start under “Form 2290 Amendments.”

From here, you can choose if you want to file a VIN Correction, a Taxable Gross Weight Increase, or a Mileage Exceeded amendment.

After that, you simply let us know if you filed with us before, and then we’re on our way to fixing that VIN!

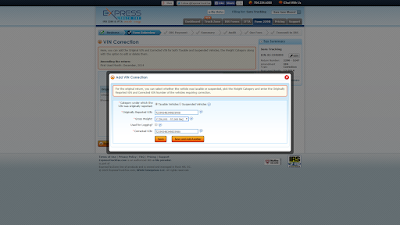

Remember, if you e-filed with ExpressTruckTax, you can just e-file a VIN correction without paying anything. However, we will need your credit card information for verification purposes, but the service itself is free. After you correct your VIN, your corrected Schedule 1 will arrive within minutes.

.png)