When you file your Form 2290 for 2020, you will need three pieces of information:

- Employer Identification Number (EIN)

- Vehicle Identification Number (VIN)

- Taxable Gross Weight and weight category of your vehicle(s)

The Taxable Gross Weight of your vehicle is the most confusing thing to figure out. Thankfully, we have you covered! Just follow the steps below to calculate your Taxable Gross Weight and weight category for filing the Form 2290.

How to calculate Taxable Gross Weight?

The Taxable Gross Weight of a vehicle is a sum of the following:

1. The actual unloaded weight of a fully equipped vehicle.

2. The actual unloaded weight of any trailers or semi-trailers that is fully equipped and is generally used in combination with the vehicle.

3. The weight of the maximum load usually carried on the vehicle and the trailers or semi-trailers.

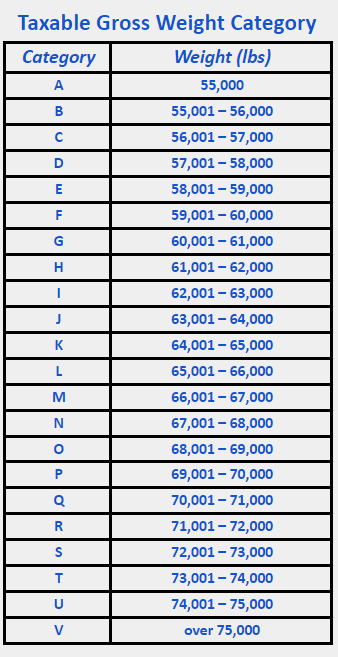

Figuring out Taxable Gross Weight Category

The Heavy Vehicle Use Tax (HVUT) is calculated based on the taxable gross weight of your truck. You are required to file Form 2290 and pay the HVUT only if the taxable gross weight of your vehicle is 55,000 pounds or more.

The HVUT will vary based on the taxable gross weight. If the taxable gross weight of your truck is 55,000 pounds, you must pay an HVUT of $100. This will increase by $22 for every 1000 pounds until the weight category reaches 75,000 pounds.

For those with a taxable gross weight of over 75,000 pounds, the HVUT amount will be $550 for the tax period.

File Form 2290 Now with ExpressTruckTax

Once you have these three pieces of information, you can e-file your Form 2290 with ExpressTruckTax and get 2290 schedule 1 in a matter of minutes!

And as always, if you have any questions about calculating your Taxable Gross Weight, our 100% US-based support team is standing by! Call (704) 234-6005 between 9am and 6pm Monday-Friday!