Are you a tax professional that needs to file Form 2290 for clients or businesses? If so, it is always important to know what you are doing and what is needed before you start filing Form 2290. Below you will find useful information that will help answer any questions you may have in regard to the Form 2290 filing process.

What is Form 2290?

Form 2290 must be filed for vehicles weighing 55,000 pounds or more to the IRS for the Heavy Vehicle Use Tax. Drivers can file this form themselves though it can also be filed by tax professionals. The tax year for Form 2290 is from July 1st to June 30th of the following year.

When is Form 2290 due?

The deadline to file Form 2290 is August 31st for vehicles that have been on the road for a year or more or are being put on the road for the first time in July. If the vehicle has been on the road for less than a year the month it is put on the road for the first time is known as the vehicle’s First Used Month (FUM). Form 2290 needs to be filed by the last day of the month following the vehicle’s First Used Month and the tax amount due will be a prorated amount for the remaining months in the tax year.

What is Form 8453-EX?

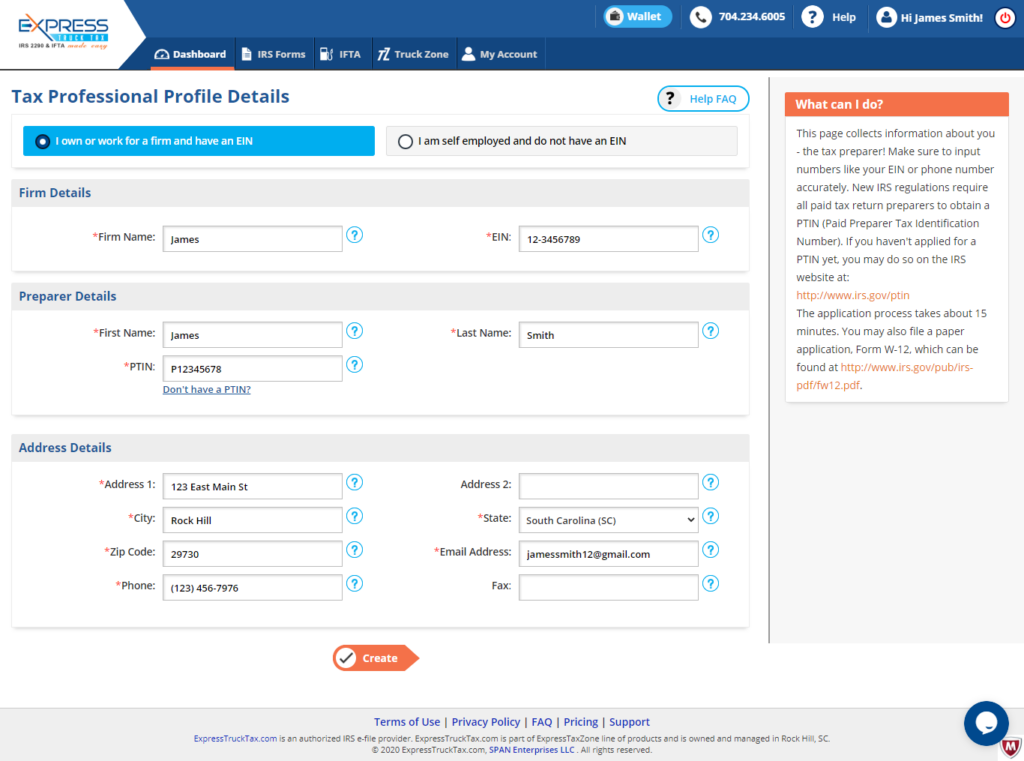

The technical term for Form 8453-EX is “Excise Tax Declaration for an IRS e-file Return”, which is a declaration by the taxpayer to authenticate an electronic Form 2290 and authorize a service provider to transmit your return using a third-party transmitter. If a paid tax preparer e-files a client’s tax return, this form needs to be filed and signed to allow the paid preparer to file the tax return on the taxpayer’s behalf. ExpressTruckTax allows Form 8453-EX to be sent directly from ExpressTruckTax to the client in order to get it signed electronically.

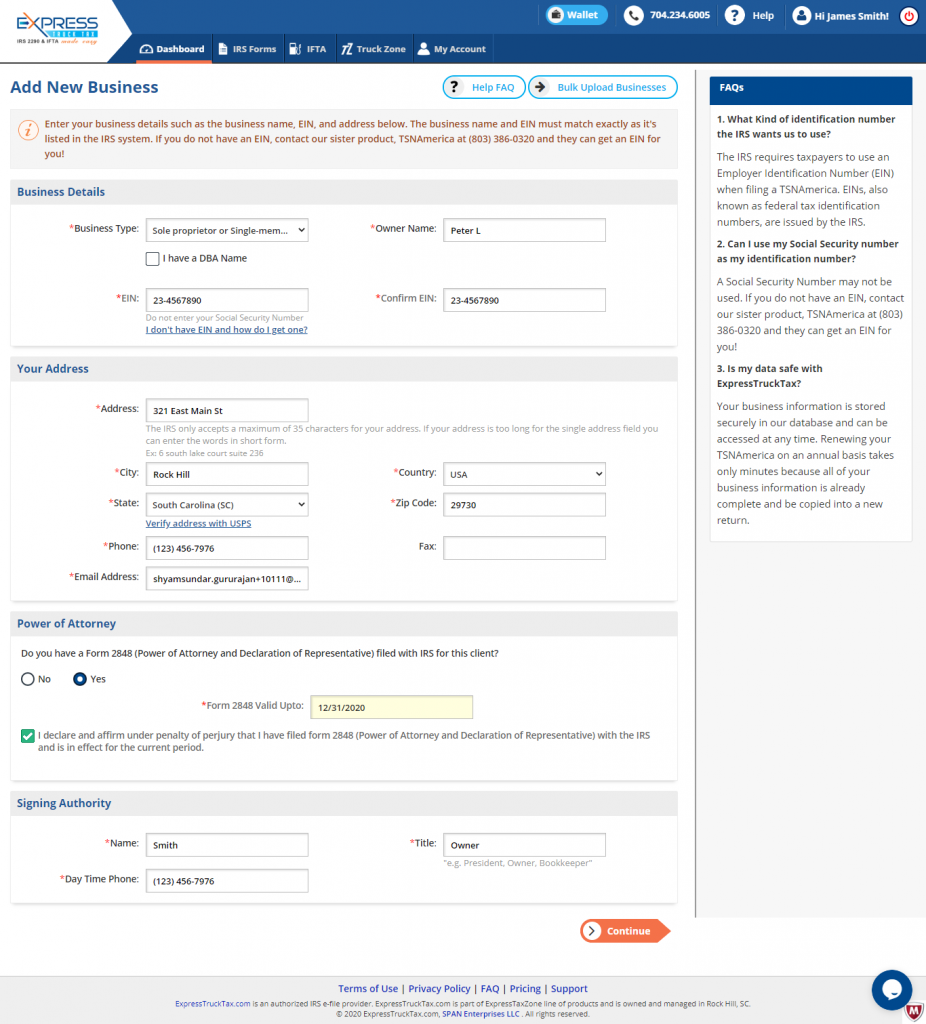

What if Tax Professionals have to file returns for multiple businesses?

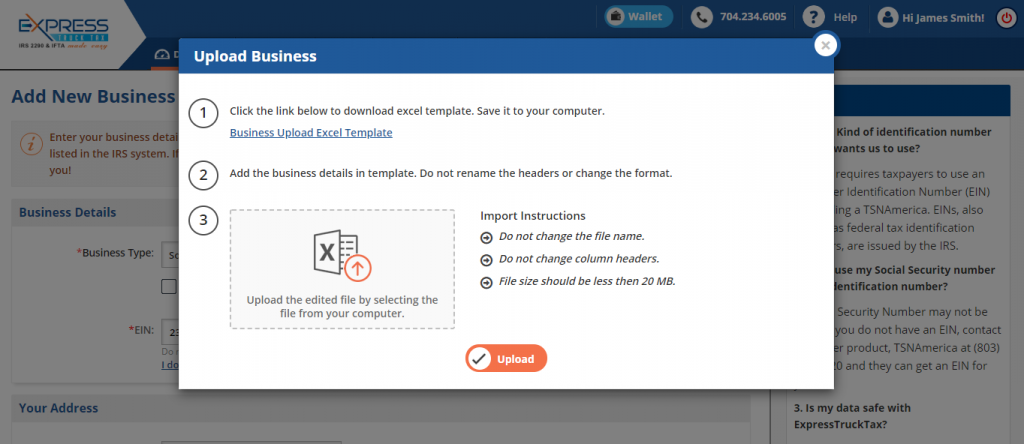

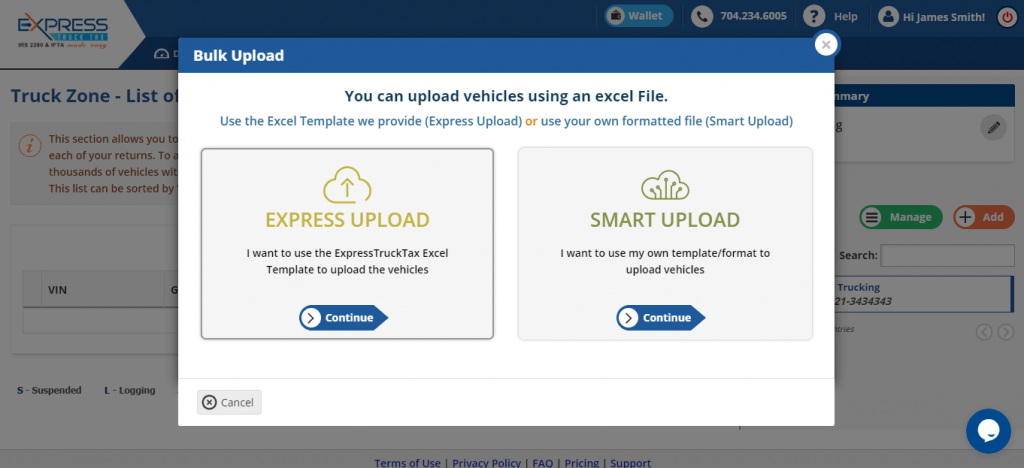

When you file with ExpressTruckTax, you are able to utilize the bulk upload feature for users to add multiple businesses at a time. Filing for each business individually can take a long time, and in order to save you time, ExpressTruckTax allows you to upload multiple businesses at once by following the steps below:

- Create an account with ExpressTruckTax or log into your existing account.

- Click “Bulk Upload businesses”.

- Download the ExpressTruckTax excel template and save it.

- Edit the document and begin entering the information for each business you need to file for.

- Make sure you do not change the name of the file of the column headers.

- Once you have entered all of the information for each business in the template, upload the document into your ExpressTruckTax account to start filing for multiple businesses within your account.

If you need the multiple business bulk upload template, click here.

How can ExpressTruckTax help Tax Professionals file Form 2290?

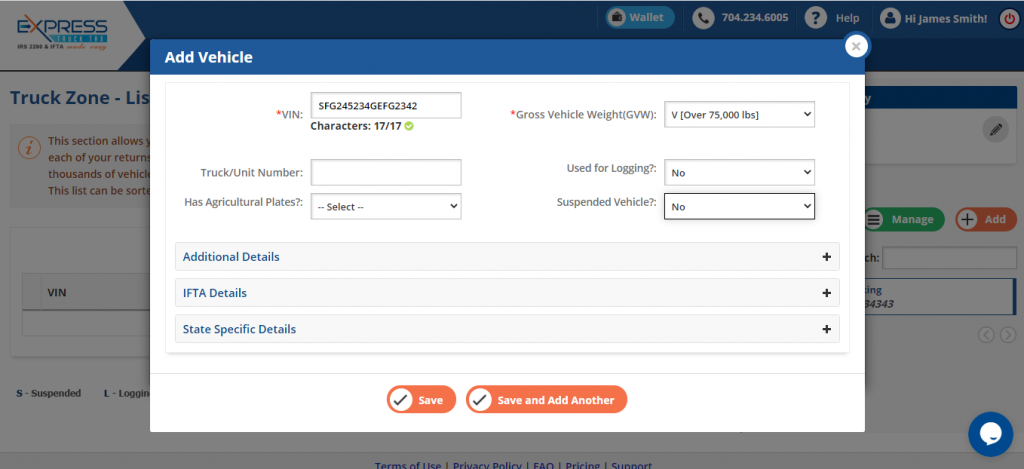

ExpressTruckTax offers a multitude of convenient options to help tax professionals e-file Form 2290. These options are designed to help save you time regardless if you are a new or returning user. New and returning users have the option to bulk-upload business and vehicle information. If there are no credit vehicles being reported for businesses you are filing for, you are able to take advantage of the Express Filing option, which presents vehicle details and payment options all on a single page. If you do need to report credit vehicles, you are able to select “Multiple Vehicles” under “Start New Return” to report any vehicles whether they are taxable, suspended, credit, or prior year suspended. These credits, if any, can be deducted from the total tax owed. If you are a returning user that has had IRS accepted returns for a business in previous filings, you are able to copy the vehicle details when filing for the current tax year. ExpressTruckTax also offers Form 2848 (Power of Attorney) to clients who are tax professionals.

Are you a tax professional and need to file Form 2290 for clients or businesses this tax year? Look no further than ExpressTruckTax. You will get access to a number of helpful features and are even able to purchase filing credits at a discounted rate for multiple filings. What are you waiting for? File your client’s Form 2290 with ExpressTruckTax today.