Truckers are the backbone of the American economy, keeping goods moving across the country and ensuring that businesses and consumers get what they need. But before any truck can hit the road, there’s a crucial step that every trucker must take: filing IRS Form 2290. This annual tax form, also known as the Heavy Vehicle Use Tax (HVUT), is mandatory for truckers operating heavy vehicles on public highways.

Failing to file Form 2290 on time can result in penalties from the IRS, as well as delays in vehicle registration, which can ultimately keep truckers off the road. Fortunately, filing this form doesn’t have to be a headache. ExpressTruckTax simplifies the process, offering truckers a quick, easy, and reliable way to file their 2290 and receive their stamped Schedule 1—often in just minutes.

In this guide, we’ll explain what Form 2290 is, why it’s critical for truckers, and how ExpressTruckTax helps drivers stay compliant, avoid penalties, and keep their trucks running smoothly.

What is IRS Form 2290?

IRS Form 2290, also known as the Heavy Vehicle Use Tax (HVUT) form, is a federal tax document required for vehicles that weigh 55,000 pounds or more and operate on public highways. The purpose of this tax is to help fund the maintenance and construction of roads, which heavy vehicles contribute to wearing down over time. Essentially, it ensures that those using heavy trucks for commercial purposes pay their fair share toward the upkeep of the infrastructure they rely on.

Why it’s Required

Filing Form 2290 is a legal requirement for truckers and fleet owners. Every year, truckers must file this form with the IRS to remain compliant with federal regulations. In addition, proof of payment for this tax (via the stamped Schedule 1) is needed to renew your vehicle registration under the International Registration Plan (IRP). Without this proof, truckers risk not being able to register their vehicle, which can lead to costly downtime and penalties.

Who Needs to File

If you’re an owner-operator or manage a fleet of heavy vehicles, you are required to file Form 2290 for each qualifying vehicle you operate. Whether you’re a solo driver with one truck or manage a large fleet, if your vehicles exceed 55,000 pounds in weight, you are subject to the HVUT and must file Form 2290 each year. It’s an essential part of staying compliant and ensuring your trucks remain road-ready.

Why Filing Form 2290 is Critical for Truckers

One of the most immediate risks of failing to file Form 2290 on time is the fines and penalties imposed by the IRS. These penalties can add up quickly and may include late filing fees and interest charges. For truckers and fleet owners, these unexpected costs can eat into profits and create unnecessary financial strain. By filing on time, you can avoid these penalties and keep more of your hard-earned money.

Maintaining Vehicle Registration

Perhaps even more critical is the requirement for a stamped Schedule 1 (proof of HVUT payment) to renew your vehicle registration under the International Registration Plan (IRP). Without this proof, you cannot legally register your truck. This can lead to costly downtime, where your truck is out of commission and unable to generate income. For owner-operators and fleet managers alike, this can result in significant financial loss. Filing Form 2290 ensures you receive your stamped Schedule 1 and can keep your trucks on the road without delays.

Ensuring Compliance

Filing Form 2290 is a key part of staying compliant with IRS regulations and avoiding disruptions to your trucking operations. Missing the filing deadline or submitting an incorrect form can trigger IRS audits, legal issues, or further complications that could prevent you from doing your job. By staying on top of your 2290 filings, you can focus on running your business and avoid costly legal or regulatory issues that might arise from non-compliance.

In short, timely and accurate filing of Form 2290 is not only essential for staying compliant, but also critical for ensuring your truck stays on the road, your registration remains valid, and your business remains profitable.

The Challenges Truckers Face When Filing Form 2290

Filing IRS Form 2290 can be more complex than it appears, especially for truckers who are constantly on the road and have little time to spare for administrative tasks. From confusing IRS terminology to common mistakes that lead to rejected filings, truckers face several challenges when trying to complete their HVUT filing correctly and on time.

Complexity of the Form

One of the biggest hurdles truckers face is the overall complexity of Form 2290. IRS language can be hard to navigate, particularly for those unfamiliar with tax terms. Miscalculating the vehicle’s weight category, for instance, is a common mistake. The form requires precise weight information, which can impact the amount of tax owed. Another challenge is understanding IRS-specific terms like the First Used Month, which refers to the month a truck first goes on the road for the tax year. Getting these details wrong can lead to filing errors that disrupt the process.

Mistakes and Rejections

Form 2290 is particularly vulnerable to errors that lead to IRS rejections. One of the most common mistakes is entering an incorrect VIN (Vehicle Identification Number), which can easily happen due to the length and complexity of VINs. Another frequent error is selecting the wrong First Used Month—truckers sometimes choose the wrong month, especially when the tax year runs differently from the calendar year. These types of errors can cause the IRS to reject the filing, forcing the trucker to refile, which can delay the issuance of the all-important stamped Schedule 1.

Limited Time and Convenience

For many truckers, particularly owner-operators, the nature of their job makes it difficult to find time to file Form 2290 manually or through complicated methods. Truckers spend much of their time on the road, making it challenging to sit down at a computer or navigate a cumbersome process during their downtime. With deadlines to meet and long stretches of driving ahead, the added stress of filing tax forms can feel overwhelming. The need for a quick, efficient, and mobile-friendly filing solution is critical to keeping their operations running smoothly without unnecessary interruptions.

How ExpressTruckTax Simplifies the Form 2290 Filing Process

Filing IRS Form 2290 doesn’t have to be a complicated or time-consuming process. ExpressTruckTax has streamlined the experience, making it faster and easier for truckers to file their HVUT (Heavy Vehicle Use Tax) and receive their stamped Schedule 1 in just minutes. With user-friendly tools and a mobile-friendly platform, truckers can handle their tax obligations efficiently, even while on the road.

Fast and Easy Filing Process

ExpressTruckTax breaks down the Form 2290 filing process into just three simple steps:

- Enter Vehicle Information: Truckers input key details such as the vehicle’s weight, VIN, and First Used Month.

- Review the Return: The system runs an instant audit and error-check to catch any mistakes before submission, helping to ensure accurate filings.

- Transmit to the IRS: After reviewing, the return is sent directly to the IRS electronically.

This simplified process allows truckers to complete their filing quickly—typically in 5 to 10 minutes—whether they’re an owner-operator or managing multiple vehicles.

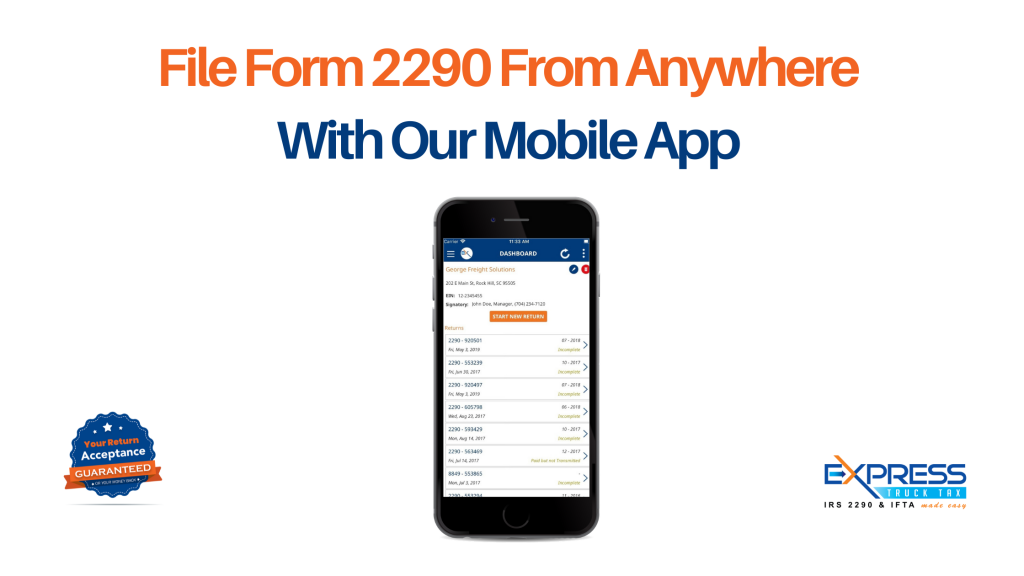

Mobile-Friendly Filing

Recognizing that truckers spend much of their time on the road, ExpressTruckTax has made the platform mobile-friendly. Drivers can file their Form 2290 using a smartphone or tablet from anywhere, whether they’re parked at a rest stop or waiting to unload cargo. This added flexibility means truckers no longer have to wait until they’re off the road or at a computer to file their taxes. Filing on-the-go has never been easier, and truckers can stay compliant without disrupting their busy schedules.

Instant Stamped Schedule 1

One of the biggest advantages of using ExpressTruckTax is the instant delivery of the IRS-stamped Schedule 1. Once the form is submitted and accepted by the IRS, the trucker will receive their official stamped Schedule 1—often within minutes. This document is crucial for vehicle registration and IRP renewal, allowing truckers to keep their trucks operational without delays.

Record Keeping and Access

Another major benefit of ExpressTruckTax is its robust record-keeping system. The platform stores Form 2290 filings and Schedule 1s for up to 7 years, allowing truckers easy access to these documents whenever they need them. This is especially helpful during audits, IRP registration renewals, or any situation where proof of tax payment is required. Instead of searching through physical files or dealing with lost paperwork, truckers can simply log in to their account, download, or print their stamped Schedule 1 with just a few clicks.

Timely Filing and Deadline Reminders

One of the biggest challenges truckers face is staying on top of important deadlines. Late filings can result in IRS penalties and fines, adding unnecessary costs to a trucker’s operation. To help avoid these issues, ExpressTruckTax sends out deadline reminders, ensuring that users are aware of when their Form 2290 is due. With these timely reminders, truckers can file ahead of deadlines.

By simplifying the filing process, offering mobile convenience, and providing fast access to the stamped Schedule 1, ExpressTruckTax helps truckers ensure that their filings meet IRS requirements. The platform’s error-checking features minimize common mistakes, ensuring that forms are completed accurately the first time.