La fecha límite para hacer sus impuestos de negocios y de ingresos personales está a la vuelta de la esquina. Así es, la fecha límite para hacer estos impuestos es el 18 de Abril. Normalmente es el 15 de abril, pero este año la fecha límite se ha movido al siguiente día hábil, el 18 de Abril. Sabemos que los últimos dos años han sido difíciles para muchos y estamos aquí para ayudar a que las cosas sean más fáciles. Si necesita una prórroga de hasta seis meses adicionales para presentar sus impuestos comerciales o personales, no busque más allá de nuestra empresa hermana, ExpressExtension.

¿Por Qué Usar ExpressExtension?

ExpressExtension es un proveedor de archivos electrónicos autorizado por el IRS similar a ExpressTruckTax. Presentar su extensión con ExpressExtension es tan fácil como presentar su Formulario 2290 con ExpressTruckTax. El cuestionario estilo entrevista, es fácil de usar y le permite presentar su prórroga fiscal comercial o personal en solo minutos. ¡También puede seguir el progreso de su extensión directamente desde su tablero! ExpressExtension también ofrece créditos prepagos a granel con descuento para profesionales de impuestos que presentan un gran volúmen de formularios para sus clientes.

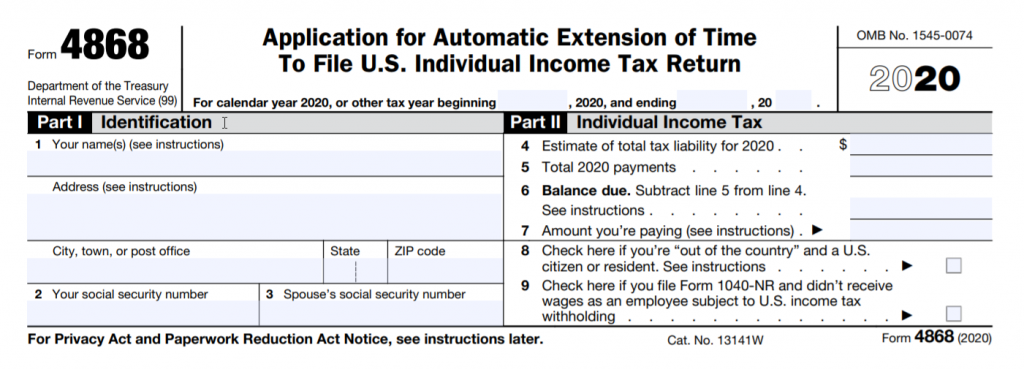

Con ExpressExtension, puede presentar el Formulario 7004 para una extensión de impuestos comerciales, el Formulario 8868 para una extensión de impuestos de organización exenta, el Formulario 4868 para una extensión de impuestos personales y el Formulario 8809 para una extensión de declaración de información.

¿Qué Estás Esperando?

ExpressExtension tiene una excelente atención al cliente disponible por teléfono, correo electrónico y chat en vivo para ayudarlo durante el proceso de solicitud de su extensión.

Si cree que necesita una extensión de impuestos comerciales o personales para la fecha límite del 18 de abril, visite ExpressExtension.com hoy y presente una extensión de impuestos federales hoy.