What is Form 2290?

Form 2290 is an IRS tax form that must be filed annually for vehicles weighing 55,000 pounds or more for the Heavy Vehicle Use Tax.

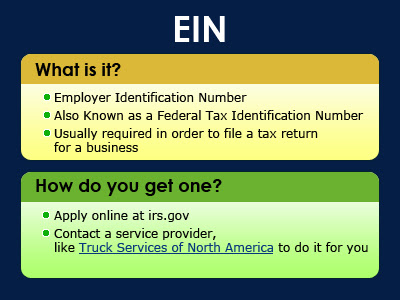

What is an EIN?

EIN stands for Employer Identification Number. It is a unique nine-digit number that the IRS assigns to businesses operating in the United States for the purpose of identification and keeping track of business tax records.

Do you need an EIN to e-file Form 2290?

In order to e-file Form 2290, you need to provide your EIN number. You are unable to e-file Form 2290 with an SSN (Social Security Number).

What should you do if you do not have an EIN?

If you do not have an EIN number and need to e-file Form 2290 you are able to apply for one online or over the phone by contacting the IRS. Once the IRS processes your request, you will receive your EIN. Please note that since the COVID-19 pandemic, it may take up to 2 to 4 weeks for your EIN to become active in the IRS e-filing system. You are also able to apply for an EIN by contacting our sister product TSNAmerica over the phone at 877-520-8640. The IRS will reject your Form 2290 if your EIN doesn’t match IRS records or if it is not yet active in the e-filing system. If your Form 2290 is rejected because your EIN is new, you are able to retransmit your Form 2290 once a day until it is accepted at no additional cost.

What if you have multiple EINs?

Each business is assigned one EIN number. Make sure to check the documents provided by the IRS when you applied for your EIN in order to find the correct EIN that corresponds with the business you are filing for. If your EIN is wrong, your Form 2290 will be rejected by the IRS.

What if you e-filed Form 2290 with the wrong EIN?

If you e-file Form 2290 and make any mistakes when entering your EIN, the IRS will reject your return. You can then retransmit your EIN with the correct EIN. If you handle multiple businesses however and use the EIN for a different business by mistake, there is a chance the IRS will not reject your Form 2290. In this case, you will need to e-file a new Form 2290 with the correct EIN and then e-file Form 8849. You will need to provide a detailed explanation as to why you are filing Form 8849 so that you can get a refund for the original filing.

Why e-file with ExpressTax?

ExpressTruckTax is an easy-to-use Form 2290 IRS-approved e-file provider. You are able to e-file your Form 2290 in just a few minutes by providing your EIN, VIN (Vehicle Identification Number), credit vehicles you plan to claim if any, and your payment information. You are also able to pay your Heavy Vehicle Use Tax directly alongside your filing fee with ExpressTruckTax. ExpressTruckTax is here to help if you have any questions about your filing and if you need a new EIN, don’t hesitate to contact our sister company TSNAmerica. What are you waiting for? E-file your Form 2290 with ExpressTruckTax now for a stress-free and easy filing experience!