The trucking industry plays a crucial role in keeping the U.S. economy moving, but with that responsibility comes various tax obligations. One of the most important taxes that owner-operators and fleet managers must pay is the Heavy Vehicle Use Tax (HVUT), which is filed using IRS Form 2290. However, not all truckers need to pay the full HVUT amount every year—certain circumstances may allow them to claim a refund or tax credit for the taxes already paid. That’s where IRS Form 8849 comes in.

Form 8849, Schedule 6, is used by truckers to request refunds or credits for excise taxes, including HVUT. Whether a truck was sold, stolen, destroyed, or driven below the mileage threshold, truckers can use this form to reclaim overpaid taxes. Additionally, if a trucker accidentally overpaid HVUT or filed with an incorrect VIN, Form 8849 allows them to correct their tax situation.

Understanding when and how to file Form 8849 is essential for truckers who want to avoid losing money due to overpaid taxes. Since tax paperwork can be time-consuming and complex, many truckers prefer to file electronically to ensure accuracy and fast processing. This article will explain what Form 8849 is, when truckers should use it, and how to file it correctly to maximize tax refunds.

What is IRS Form 8849?

The IRS Form 8849, Claim for Refund of Excise Taxes, is a tax document used by businesses and individuals to request refunds of excise taxes that were previously paid to the IRS. Since truckers and trucking businesses pay Heavy Vehicle Use Tax annually through Form 2290, they may need to file Form 8849 when they overpay HVUT or when circumstances allow them to claim a refund.

This form is a vital tool for truckers looking to recover unnecessary or excess tax payments without needing to apply the credit to future tax filings. Instead, Form 8849 allows truckers to receive a direct refund from the IRS.

Why is Form 8849 Important for Truckers?

Truckers and fleet owners file Form 2290 each year to pay HVUT on their taxable heavy vehicles (those weighing 55,000 pounds or more). However, not all trucks remain taxable throughout the tax period (July 1 – June 30). Some trucks may be sold, destroyed, stolen, or driven below the mileage threshold, making them eligible for an HVUT refund. Instead of waiting for future tax credits, truckers can file Form 8849 to get their money back faster.

When Should Truckers Use Form 8849?

Truckers who have already paid the Heavy Vehicle Use Tax (HVUT) through Form 2290 but later find that they overpaid, filed incorrectly, or no longer need to pay HVUT for a specific vehicle can use IRS Form 8849, Schedule 6, to claim a refund. Since HVUT is an annual tax that covers the July 1 – June 30 tax period, truckers should file as soon as they become eligible for a refund to avoid unnecessary delays.

There are four main reasons why a trucker might need to file Form 8849 for an HVUT refund:

1. Vehicle Sold, Destroyed, or Stolen

If a truck is sold, totaled in an accident, or stolen before the tax year ends, the owner is no longer required to pay HVUT for that vehicle for the remaining months of the tax period. Instead of waiting to apply the credit to next year’s return, truckers can use Form 8849 to get an immediate refund for the unused portion of their HVUT.

How the IRS Calculates Refunds for Sold, Destroyed, or Stolen Vehicles

- The IRS issues prorated refunds based on the number of months left in the tax period after the vehicle is sold, stolen, or destroyed.

- The HVUT tax period runs from July 1 to June 30, and taxes are paid for the full year in advance.

- If the vehicle is removed from service in October, for example, the trucker may qualify for a refund for the remaining eight months (November–June).

Refund Table for Sold, Stolen, or Destroyed Vehicles:

Example:

- A trucker pays $550 in HVUT for a vehicle on July 1.

- The truck is sold in October (after 4 months of use).

- The trucker can file Form 8849 for a refund on the remaining 8 months’ worth of HVUT.

- The IRS will calculate the refund based on the prorated tax amount.

To claim this refund, truckers must provide documentation proving the sale, destruction, or theft of the vehicle, such as a bill of sale, police report, or insurance claim document.

Supporting Documentation:

To guarantee correct processing of Form 8849, here are examples of documents you should have available:

- Sold Vehicle: Bill of sale or transfer document

- Destroyed Vehicle: Insurance claim or mechanic’s report

- Stolen Vehicle: Police report

2. Low Mileage (Suspended Vehicle Credit)

Not all heavy vehicles are subject to full HVUT. If a truck is expected to travel less than 5,000 miles (or 7,500 miles for agricultural vehicles) during the tax period, it is considered a “suspended vehicle“ and does not owe HVUT.

How the Mileage Exemption Works

- When filing Form 2290, truckers still list all heavy vehicles, including low-mileage vehicles, but they classify them as suspended vehicles.

- If a trucker mistakenly pays HVUT on a vehicle that remains under the mileage threshold, they can use Form 8849 to request a refund for the overpaid amount.

Example:

- A trucker pays HVUT in July for a truck but later realizes that the vehicle only logged 4,500 miles during the tax year.

- Since the vehicle stayed below the 5,000-mile threshold, the trucker can file Form 8849 to claim a refund for the full HVUT amount.

To qualify for this refund, truckers must keep accurate mileage logs as proof that the vehicle did not exceed the mileage limit. These should be prepared and submitted when Form 8849 is filed.

3. Overpayment of HVUT

If a trucker accidentally overpays HVUT while filing Form 2290, they don’t need to wait until next year to use the excess as a credit. Instead, they can file Form 8849 to get a direct refund from the IRS.

Common Causes of HVUT Overpayment

- Duplicate payment: A trucker accidentally submits multiple HVUT payments for the same vehicle.

- Incorrect weight category: If a trucker reports a heavier vehicle weight category than necessary, they may overpay their HVUT.

- Filing errors: Clerical mistakes, such as entering the wrong tax amount, can lead to overpayments.

Example:

- A trucker owns a vehicle that weighs 55,000 pounds but mistakenly files Form 2290 under the 80,000-pound weight category, paying a higher tax rate.

- The trucker can file Form 8849 to get a refund on the excess tax amount paid.

Truckers should review their Form 2290 carefully before submitting to avoid overpayments, but if mistakes happen, Form 8849 provides a solution.

4. Incorrect VIN on Form 2290

The Vehicle Identification Number (VIN) is a crucial detail on Form 2290, as it identifies the truck subject to HVUT. If a trucker accidentally enters the wrong VIN when filing Form 2290 and pays HVUT under the incorrect number, they will need to correct the error and may be eligible for a refund on the mistaken payment.

How to Fix a VIN Error and Claim a Refund

- File a VIN Correction (Form 2290 Amendment)

- If a trucker realizes they made a small typo in the VIN on Form 2290, they can file a free VIN correction through ExpressTruckTax to fix it.

- A VIN correction does not require a refund request if the same truck is still being taxed.

- Request a Refund if HVUT was Paid on the Wrong VIN

- If HVUT was paid on the wrong VIN entirely (i.e., a different truck), the trucker must file Form 8849 to get a refund and then refile Form 2290 with the correct VIN.

Example:

- A trucker owns a truck with VIN 1HGBH41JXMN109186 but accidentally enters 1HGBH41JXMN109189 when filing Form 2290.

- Since the IRS does not allow direct edits to a VIN on a paid Form 2290, the trucker must:

- File Form 8849 to claim a refund for the incorrect VIN’s HVUT payment.

- Refile Form 2290 under the correct VIN and pay the correct HVUT amount.

This ensures that the trucker’s HVUT payment is correctly applied to the right vehicle, avoiding issues with the IRS and state DMVs when registering the truck.

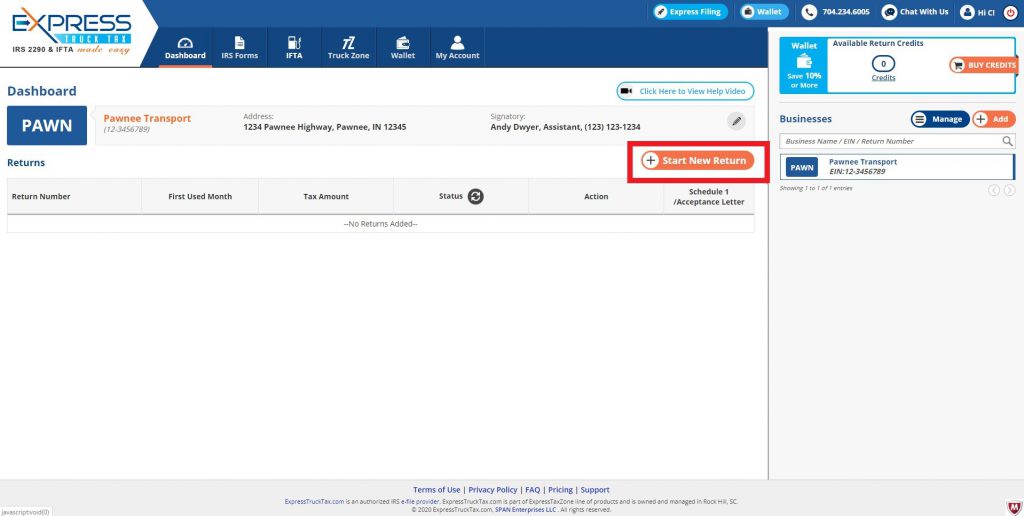

Why Truckers Should File Form 8849 Electronically

Filing Form 8849 for an HVUT refund is a great way for truckers to recover money from overpaid taxes, but IRS refund processing can take 4-6 weeks or longer if errors occur.

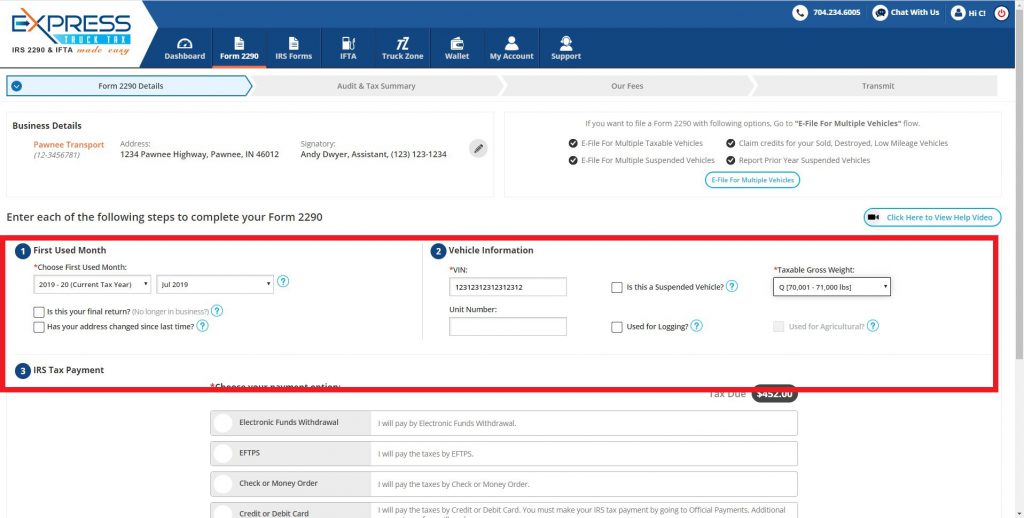

To speed up the process and ensure accuracy, truckers can use ExpressTruckTax, which offers:

- Automatic Form 8849 generation when applicable (saves time)

- Instant error checks to prevent IRS rejections

- Fast electronic filing for quicker refunds

- Bilingual US-based customer support for assistance

By filing Form 8849 electronically, truckers can avoid delays, reduce paperwork, and get their HVUT refunds processed faster. If you believe you qualify for a refund, don’t leave money on the table—file Form 8849 today!

FAQ’s

1. What is IRS Form 8849, and why do truckers need it?

Form 8849, Schedule 6, is used by truckers to claim refunds on excise taxes, including overpaid HVUT. If a truck was sold, stolen, destroyed, or driven below the mileage threshold, truckers can file this form to recover tax payments instead of waiting for a credit on next year’s Form 2290 filing.

2. When should I file Form 8849 for an HVUT refund?

You should file Form 8849 as soon as you become eligible for a refund, such as:

- If a truck was sold, stolen, or destroyed before the end of the tax year.

- If you overpaid HVUT due to a clerical error or duplicate payment.

- If a truck qualifies as a low-mileage (suspended) vehicle but HVUT was still paid.

- If you filed Form 2290 with the wrong VIN and need to correct it.

Filing sooner helps avoid delays in IRS processing and ensures you receive your refund faster.

3. How long does it take to get an HVUT refund from the IRS?

IRS processing times for Form 8849 refunds typically take 4 to 6 weeks. However, errors in filing or missing documentation can cause delays.

To speed up processing, truckers can e-file Form 8849 using ExpressTruckTax, which:

- Prevents common mistakes with instant error checks

- Ensures faster processing through electronic filing

- Provides status updates on your refund request

4. What documents do I need to submit with Form 8849?

The IRS requires proof of eligibility for an HVUT refund. Depending on the reason for your refund request, you may need to provide:

For Sold Vehicles: Bill of sale or transfer document

For Stolen Vehicles: Police report

For Destroyed Vehicles: Insurance claim or mechanic’s report

For Low Mileage (Suspended Vehicle) Credit: Mileage logs

For VIN Errors: Proof of incorrect VIN filing and corrected Form 2290

Keeping accurate records ensures faster refund approval.

5. How does the IRS calculate HVUT refunds for sold, stolen, or destroyed vehicles?

The IRS provides prorated refunds based on how many months remain in the tax period after the vehicle was removed from service.

Refund Calculation Example:

A trucker pays $550 in HVUT on July 1 but sells the truck in October (after 4 months of use). The trucker can claim a refund for the remaining 8 months (November – June).

6. Can I get a refund if I mistakenly overpaid HVUT?

Yes! If you accidentally overpaid HVUT when filing Form 2290, you can use Form 8849 to request a refund instead of waiting for a credit on next year’s tax return.

Common reasons for HVUT overpayment:

- Duplicate payment (filed Form 2290 twice)

- Wrong weight category (reported a heavier vehicle than necessary)

- Clerical errors (incorrect tax amount entered)

If you realized an overpayment, file Form 8849 electronically for faster processing.

7. What should I do if I entered the wrong VIN on Form 2290?

If you mistakenly entered an incorrect VIN when filing Form 2290, you have two options:

- Minor VIN Error: File a VIN correction (free through ExpressTruckTax). No refund is needed if the correct vehicle was taxed.

- Paid HVUT for the Wrong VIN: File Form 8849 to request a refund and refile Form 2290 with the correct VIN.

It’s essential to correct VIN errors quickly to avoid delays in receiving your stamped Schedule 1.

8. Why should truckers file Form 8849 electronically instead of mailing it?

Filing Form 8849 by mail can lead to longer wait times and a higher chance of IRS rejections due to errors.

Benefits of E-Filing Form 8849 with ExpressTruckTax:

- Instant error checks prevent rejections

- Faster IRS processing = quicker refunds

- Easier form completion with auto-populated data

- 24/7 access to your stamped Schedule 1 and refund status

Don’t wait for paper processing—e-file today and get your money back faster!

9. Where can I check my Form 8849 refund status?

Since Form 8849 refunds are processed directly by the IRS, truckers can check their refund status by:

- Calling the IRS Excise Tax Help Desk at (866) 699-4096

- Checking their IRS account online for refund updates

If you file electronically through ExpressTruckTax, you will receive real-time updates on your Form 8849 filing and refund status.

10. How do I file Form 8849 for an HVUT refund today?

Filing Form 8849 is quick and easy with ExpressTruckTax:

- Step 1: Sign in to your ExpressTruckTax account.

- Step 2: Select Form 8849 – Schedule 6 and enter refund details.

- Step 3: Submit electronically and get IRS confirmation.

File now to get your refund faster! Start Filing Form 8849 Now.

.png)