With tax season underway, many of you are e-filing and getting ready to finish up your summer on a high note. Well, Trucking Nation, we’ve got just the thing! July’s truck-tastic trucking events!

This months events will certainly not disappoint (since most of them are FREE). Enjoy some trucking awesome truck shows and the top gun large car shootout! It’s the perfect mid-summer treat for the whole family!

Fitzgerald Truck Show

Kicking off the events on July 17-18th, is the Fitzgerald Truck Show in Crossville, Tennessee. This event is FREE to the public! There will be food, games, music, and fun for the whole family. Enjoy amazing trucks from all over the country that will be competing in the Pride and Polish Beauty Competition.

Then, if you need a little more action in your summer, Two-time Guinness World Record holder, Jesse Toler will be there with his crew to perform their fantastic stunt-bike show. And there will be fireworks and a bouncy castle for the kids! This event is going to be trucking awesome!

Truck Function in Junction

Right after the Fitzgerald Truck Show, you can enjoy the Truck Function in Junction. It takes place on July 18th in Junction City, Oregon, and it’s going to be truck-tastic. See some great trucks in the show n’ shine and then stick around to hear Amy Clawson perform!

There will be food, fun, family friendly events and best of all, it’s free!

Top Gun Large Car Shootout

Then mid-month when the temperatures are at an all time high, you can escape the heat by heading up North to Rantoul, Illinois, for the Top Gun Large Car Shootout. Another trucking awesome FREE event for July!

So grab your family and come out to see the best working class truck show in Rantoul, IL. There’s something for everyone to enjoy! From the parade of lights, to the Kiddie Pedal Pull, awesome local food vendors, and a Beer Garden, this is an event you don’t wanna miss!

Keystone Diesel Nationals

If you summer hasn’t had enough excitement after all these truck-tastic events, drop on by the Diesel Truck Nationals in Reading, Pennsylvania. Watch some of the best truck races you’ll ever see in your life in the Diesel Drag Races and the Jet Dragster Races.

Then, while you’re still filled with excitement from rooting for your favorite trucks, enjoy the Monster Truck Rides and the XDP Car Crusher. There’s even a Kid Zone for any little ones you have with you and a Parade of Trucks for the whole family to enjoy. Along with some great food and music, of course!

Color & Chrome Fantasy Truck Show

Finally, at the end of the month from July 21st-August 2nd enjoy the 6th annual Color & Chrome Fantasy Truck Show in Ogallala, Nebraska. Yet another wonderful FREE event for the whole family to enjoy!

Come out and vote for your favorite truck (color or chrome) and enjoy some great food, great music, and great people for three nights of non-stop fun. You don’t want to miss this event!

Coming Soon: The Great American Trucking Show

Now, The Great American Trucking Show doesn’t actually happen until next month in Dallas, Texas, from August 27th-29th, but it’s such a huge event we’re already excited about it! There will be tons of truckers, truck enthusiasts and awesome trucks from all over North America. And all in one place!

You definitely don’t want to miss out on everything they have to offer! From talent searchers to truck industry networking, and a bunch of new truck tech previews it’s basically the event for truckers.

So get excited, Trucking Nation, because you don’t wanna miss The Great American Trucking Show!

Don’t forget to Tweet at us or post on our Facebook page if you make it out to any of these events. We love event stories and photos, and there’s a ton of great events going on this month that you don’t want to miss out on. Especially once you get your e-filing out of the way! So enjoy July’s truck-tastic FREE trucking events.

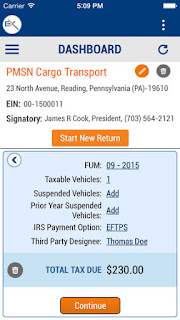

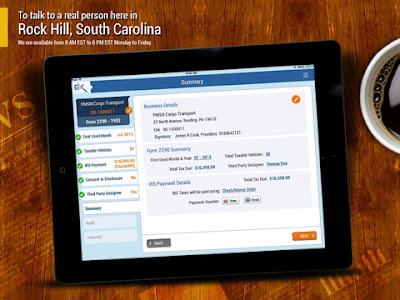

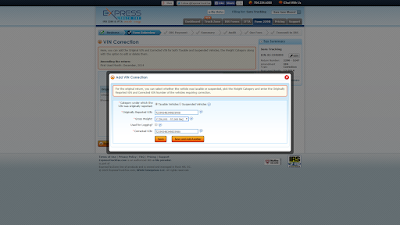

And, since we are in the midst of HVUT season, if you need any help e-filing, then don’t hesitate to ask our dedicated support legends. Give them a call at 704.234.6005 during our new extended hours from 8AM to 8PM or send them an email at support@expresstrucktax.com for 24/7 support in English and Spanish.