If you’ve e-filed with us before, you may have noticed an option to select “Final Return” at the step where you enter your first-use-date and filing year. But what exactly does selecting “Final Return” mean?

In the past, selecting “final return” on your 2290 meant that you could no longer e-file your HVUT, but now the IRS wants you to select “Final Return” when you no longer have a vehicle to e-file for.

Whether your vehicle has been sold, stolen, or destroyed, if you no longer have a Heavy Vehicle to e-file for, you should choose “Final Return”. And in the event you find yourself with a new vehicle and able to file your HVUT again, all you have to do is e-file normally.

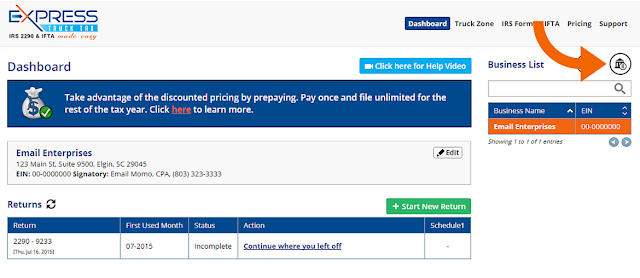

Where to Find “Final Return”

At the beginning of your return, after you enter your business information, and select your filing year, you’ll find an option to select “Final Return” at the bottom of the page.

Only select this option if you no longer have a vehicle to file for. If this is not your final return, simply file your return as normal.

Is It Any Different than Filing Normally?

Filing for your final return will be the same as filing from year to year, with the small difference of selecting “Final Return,” and adding a credit vehicle instead of a suspended or taxable vehicle.

Reporting Stolen, Sold, and Damaged Vehicles

When you file your return, there’s a whole section dedicated to credit vehicles. These are vehicles that were sold, traded in, lost, or destroyed during the tax year. If this is your final return, you’re only going to be entering a Credit Vehicle.

Once you get to the “Credit Vehicle” section of your return, simply add your vehicle information in the pop-up window. You will need to know your VIN, first-used month, gross-vehicle weight, and whether your vehicle was used for logging.

Then it’s time to indicate your “Loss Event.” These event reasons come in the form of a drop down menu and all you have to do is select the reason you no longer have your vehicle. Was it sold, destroyed, or stolen?

If the vehicle was sold, you will need the information of the person you sold it to in order to file your return. Then just add the date this event happened for that specific loss event, and move onto the next part of your return.

If you need any help with e-filing or have questions about when to select your final return, our dedicated support legends are here for you. Just give them a call at 704.234.6005 or send them an email at support@expresstrucktax.com for 24/hour support in both English and Spanish.