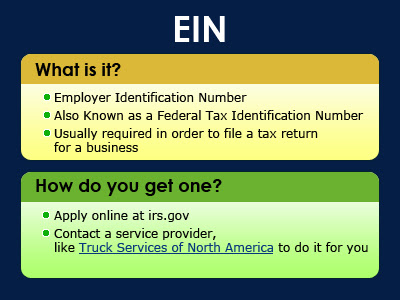

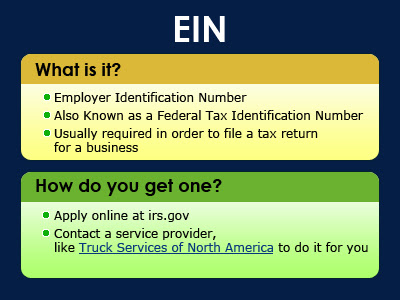

An EIN is an Employer Identification Number, also known as a Federal Tax Identification Number, and can be used to verify a business entity. An EIN is usually required in order to file a tax return for a business. If you do not have an EIN, you can apply for one online through the IRS website or if you don’t have the time or unable to get to a computer, you can have a service provider, like Truck Services of North America to do it for you.

Please note that if you obtain a new EIN it takes approximately 10 business days for the EIN to become active within the IRS’ e-file system, thus you should wait until after this period to complete a tax form online.

If you are filing Form 2290 for Heavy Vehicle Use Tax (HVUT), you will also need an EIN to file the return. The IRS will no longer accept Social Security Numbers for the Form 2290. It must be an EIN.

The Form 2290 can be E-Filed online through the IRS-Authorized E-File provider ExpressTruckTax.com If you have any questions, you can contact the Truck Tax Team at 704.234.6005

As some of you may have noticed, the IRS E-Filing System was down from late December until early January for anyone who needed to file the

Form 2290 online. This was due to the yearly maintenance the IRS performs for its servers at the end of each year. If anyone submitted an IRS Form 2290 for Heavy Vehicle Use Taxes online during this time period through ExpressTruckTax.com the return was placed on hold until Monday, January 9, 2012. The returns have now gone through to the IRS and if anyone has new returns that need to be filed, they will not have to endure the wait that they would have had if they filed in late December.

Each person who files the

IRS Form 2290 with the IRS through Express Truck Tax will receive Free Fax and Email Notifications to let them know when the Schedule 1 is ready. The taxpayer also has a variety of options if they would like to receive optional Text Message reminders as well. These Reminders can also notify your contracting or leasing company as well to let them know that a payment has been made. There is no additional cost to have the information sent directly to a contracting or leasing company.

The IRS payment can be made by 4 methods: Electronic Funds Withdrawal, EFTPS, Check, or Money Order. The IRS does not accept Credit Cards for the

Heavy Vehicle Use Tax Payment. (The filing fees imposed by Express Truck Tax can be paid by Credit Card if you wish)

To pay by Electronic Funds Withdrawal, the IRS will need a bank account and routing number. For EFTPS, the taxpayer would need to have already setup an account within the

Electronic Federal Tax Payment System. In order to pay by Check or Money Order, the form can still be filed instantly online, and a Payment Voucher can be printed and mailed to the IRS. The last page of the Form 2290 is a 2290-V (or payment voucher).

Filing this form online only takes a few minutes and you will receive a

stamped Schedule 1 within minutes of filing this form online with Express Truck Tax. Although the deadline is approaching, you will still be able to E-File your Form 2290 through our service anytime. If you have any questions, please contact us at our USA-based customer support center in Rock Hill, SC at 704-234-6005 or email us at

support@ExpressTruckTax.com.

Posted on August 27, 2011 by Santamarina Joseph - 2290 e-file, 2290 form, e-file 2290, express2290.com, Expresstrucktax.com, Form 2290, Form 2290 2011, form 2290 Schedule 1, form2290.net, irs 2290, Tax 2290

There are several taxes that are imposed on those in the trucking industry each year. Heavy Vehicles travelling on public highways are subject to HVUT, or Heavy Vehicle Use Tax. These taxes can be filed by filing a Form 2290. Truckers, owner operators, and trucking companies were recently notified by the IRS that their next highway use tax return for filing HVUT (which is usually due on August 31) will instead be due on November 30, 2011. The primary reason for the extension of the due date is to reduce confusion and multiple filings of Form 2290 that could result if Congress reinstates or makes changes to the current highway use tax after September 30, 2011.

The previously mentioned Heavy Vehicle Use Tax applies to trucks, truck tractors and buses with a gross taxable weight of 55,000 pounds and above. There are also many detailed rules and regulations that apply to vehicles with minimal road use, logging/agricultural vehicles, vehicles transferred during the year, and also those whose first use month was during July. In typical scenarios, vans, pick-ups and panel trucks are not taxable because would [under normal circumstances] fall below the 55,000 pound requirement.

The recently determined filing deadline of November 30 for Form 2290 (Heavy Highway Vehicle Use Tax Return) applies to the tax period beginning on July 1, 2011. This does not only include those vehicles that were used during July, it also includes those whose first use month was during August or September. According to recent statements from the IRS, 2290 tax returns should not be filed and payments should not be made until November 1, 2011.

Regulations for new vehicles that need to be registered will also take effect. Any new vehicle that needs to be registered during July through October of 2011, state DMV’s are now required to accept a Stamped Schedule 1 from the previous year since it is not possible to receive a stamped Schedule 1 until November of 2011. If a vehicle was acquired within the current tax year, and there is not a stamped Schedule 1 for the previous year, the owner only needs to provide some form of proof of purchase to prove that the vehicle was recently placed in his/her possession.

Fortunately, once the Form 2290 is available, the electronic filing service: ExpressTruckTax.com will be able to E-File the form and send it to the IRS in minutes. Express Truck Tax is an IRS Authorized E-File provider for filing Form 2290. The E-Filing Process is very simple; the form can be completed in minutes, and it can be sent to the IRS as soon as it is finished. It is such a time saver when you compare it to waiting in the IRS office for hours or sending it via postal mail and waiting weeks for the IRS to process it. All you will need is your basic information about yourself, and your truck.

Posted on August 22, 2011 by Santamarina Joseph - 2290 e-file, e-file 2290, express2290.com, Expresstrucktax.com, Form 2290 2011, Form 2290 HVUT, form 2290 Schedule 1, form2290.net, HVUT Instructions, HVUT Payment, irs 2290, Tax 2290

As anyone who is a veteran of the Trucking Industry will tell you, there are many more business and economic responsibilities other than simply getting something delivered at the right time and place. Heavy Vehicle Use Tax, or HVUT, is one of the most common taxes on heavy highway vehicles in the United States. Paying this tax properly involves filing the IRS Form 2290. This Form is so easy to E-File online, and thanks to Express Truck Tax, there is no reason to be late, as evidenced by these points:

- IRS Fines

- Unless you enjoy IRS Audits and spending time in courtrooms, it is a terrible to not pay your taxes. The IRS can add all kinds of interest and late fees, but if you end up in court over the matter it will lead to the court costs as well as heavy fines.

- Not filing or not paying is a felony

- Fines are bad enough, but it could be worse. Going to court can lead to criminal charges. The IRS & state governments could prosecute anyone who purposely cheats to avoid paying the truck tax. It can also lead to time in prison.

- Stay focused on your business

- If these are not paid in a timely manner, the previously mentioned fines, court appearances, and possible jail time could seriously put a halt on your business. The time and energy spent worrying about IRS Audits, Fines, and Court Dates is not worth it. Especially when the taxes are not typically very high.

- Taxes help improve public roads

- Paying taxes is never a joyful experience, but you should get some gratification in the fact that much of the taxes paid for HVUT go back into the cost of roads and highway expenses. It just makes sense; if you enjoy using something, you shouldn’t mind paying for it.

- It’s So Easy

E-file IRS form 2290 with expresstrucktax.com on time. It’s made as easy as 1-2-3 to e-file truck tax 2290 and get IRS stamped Schedule 1 in few minutes. Avoid IRS penalties and Audits by keeping your 2290 records with express truck tax. E-file IRS 2290 VIN Corrections for free of cost.