Unfortunately, many unscrupulous Form 2290 providers have popped up in recent years. These providers are only interested in copying the work of industry veterans like ExpressTruckTax, i2290, J.J. Keller, 2290Tax, and Comdata and making a quick buck. They have no vested interest in helping American truckers. For more information about these copycats, check out this great article by Overdrive magazine.

The main problem is that these new players don’t have the established security workflows of veterans like us. They have not been around long enough to prove that they will protect sensitive all your sensitive business information.

E-filing your Form 2290 requires a lot of confidential business information to be entered. For instance, your EIN is required on your 2290 and for almost every business-related transaction, including opening business bank accounts, business loans, and credit accounts, and merchant credit card processing accounts. In fact, fraudulent accounts can be opened by identity thieves with nothing more than a business name, address, and EIN.

So how can you be absolutely sure you’re using a trustworthy service to e-file your Form 2290? Well first, we recommend e-filing with established veterans like ExpressTruckTax and others who have been around for over a decade.

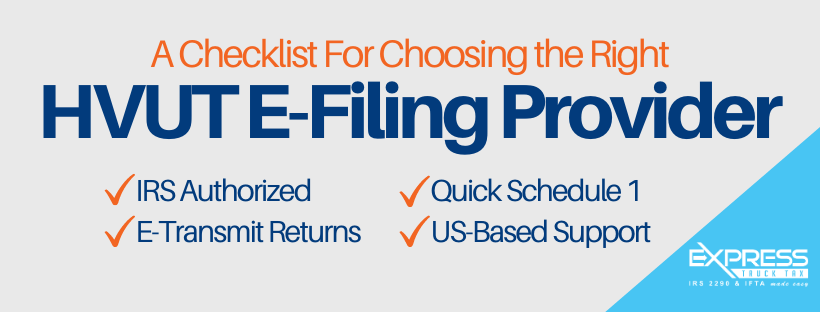

But additionally, here are some things to look out for when verifying the legitimacy of a Form 2290 e-file provider (or really any e-file provider).

1. Look for the Authorized IRS E-file Provider Stamp (and listing on the IRS site)

This stamp will appear on the website of all legitimate e-file providers. Period. E-file providers are legally required to have this seal of IRS approval if they file more than 11 forms a year (and who would trust the competency of someone who only files a few forms a year?).

If you do see the IRS stamp on a provider’s website, be sure to check that the e-file provider actually appears in the IRS approved list of 2290 e-filers.

While the IRS authorization process is rigorous, not all e-file providers are created equal.

2. Make sure the website is secure.

In our research, we came across several IRS approved e-file providers whose websites were blocked by our browser for security reasons. It’s essential that e-file providers have a robust system in place to secure and protect your business information.

3. Check for a physical address listed on the provider’s website (it can often be found under “Contact Us” or “About Us”)

Among the providers listed as IRS approved, many have nothing but a P.O. Box number. Most of the time this means that they don’t care about investing in important things like having an actual office with a physical address and protecting your confidential information. These are often the kind of providers who file your taxes out of their home or garage or from another country. Does anyone really want to trust their taxes with a provider who has nothing but a laptop in their basement?

Be sure to look for actual photos of the team in the “About Us” section of each website. If there’s nothing more than fancy text on the screen, be sure to look elsewhere.

4. Expect real, US-based phone support

Just because the provider is IRS approved, it doesn’t mean that the support staff is based in the United States. There are a number of e-file providers who have small US offices but are actually based out of other countries.

Plus, for small operations, it’s often more economical to outsource phone support to call centers. These phone banks could be located in other countries.

Expect quality US-based phone support from real people. Don’t settle for anything less than the highest quality service when filing your taxes.

5. Check for active social media accounts

A social media presence is as much a matter of competency as it is of security. If an e-file provider doesn’t have or maintain social media, what does that say about their technical prowess and dedication? It is not difficult to actively update a Facebook or Twitter page once a week.

These are e-file providers after all. They really ought to be tech-savvy enough to update social media if they are sending tax information electronically to the IRS!

And if there’s more than one person behind the operation, there ought to be actual photos or videos of the staff out there on social media.

At the end of the day, treat your business information just like your personal information. Be smart. Be safe. Do your due diligence when e-filing your trucking taxes.