As a truck owner or fleet manager, tax filing the IRS Form 2290 can be a daunting task, consuming valuable time and resources. However, with the help of the TruckZone feature in ExpressTruckTax, managing your trucks has never been easier.

ExpressTruckTax offers a range of features to simplify the filing process, ensuring accuracy, efficiency, and peace of mind. In this blog post, we will explore one of the standout features of ExpressTruckTax (the TruckZone) and how it can simplify your filing experience.

What is the TruckZone?

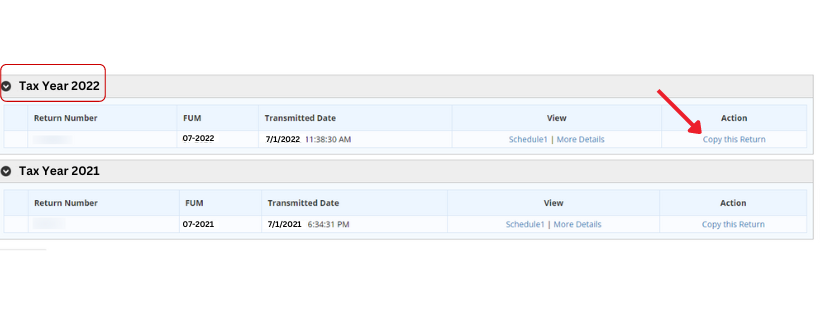

The TruckZone is an ExpressTruckTax exclusive feature. Think of it as a digital garage. Whether you have one truck or thousands of trucks, the TruckZone helps you organize your fleet so that e-filing your Form 2290 each year is simple! The information you enter for each truck is saved and can be auto-populated on future returns.

How Does the TruckZone Work?

The TruckZone feature in ExpressTruckTax simplifies the tax filing process and organization in just a few steps.

There are 2 ways to import vehicle information into TruckZone.

- Manual Upload: Click the +Add Vehicle button and manually enter the vehicle’s information such as the VIN, Gross Weight, and other important information for the Form 2290 filing. You can also go the extra mile and enter IFTA and state-specific information as well.

- Bulk Upload: You can upload an Excel or CSV file directly into the TruckZone, saving you time and hassle. Once the vehicles are uploaded, you select any of these vehicles to add to your Form 2290, and you can always edit the details anytime.

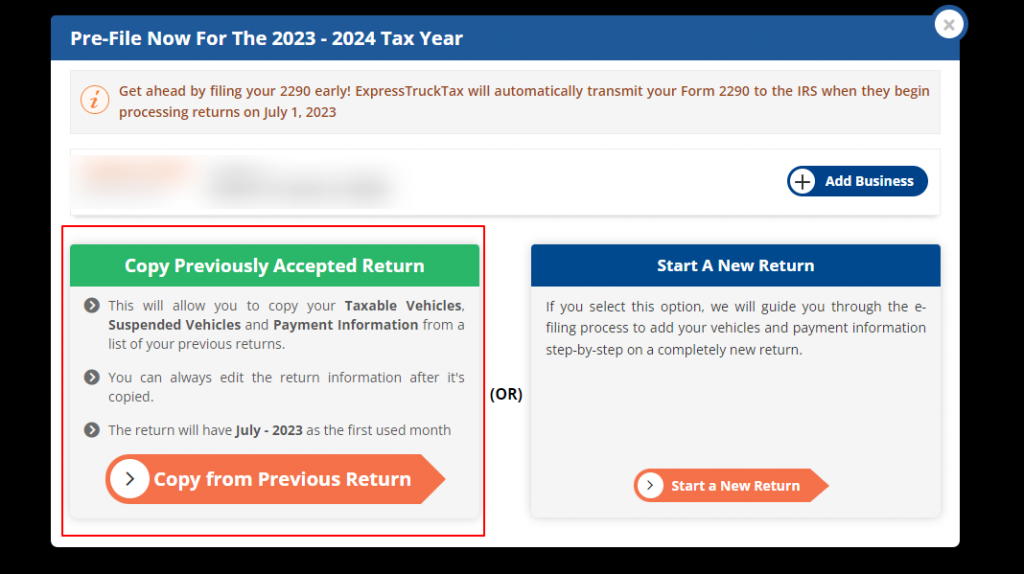

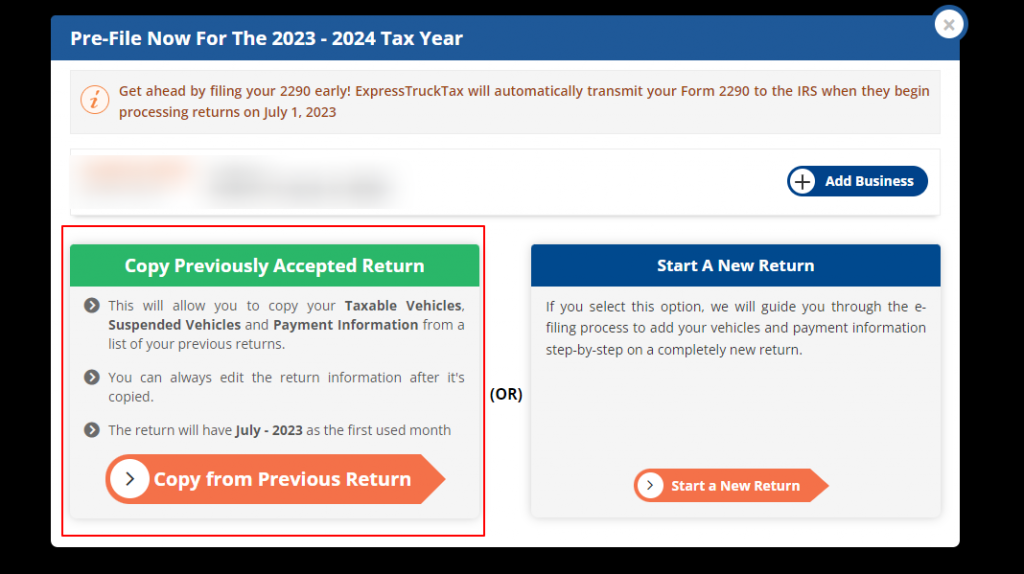

You can add vehicles from the TruckZone directly to your Form 2290 by choosing ‘Import Vehicle from TruckZone’ when filing a single truck or ‘Import from TruckZone’ on the Taxable Vehicle page when filing for multiple vehicles.

Single Vehicle:

Multiple Vehicles:

The Benefits of TruckZone

The most notable feature of the TruckZone is the ability to search for a Schedule 1 for a specific vehicle without having to sift through hundreds of returns. Just search for the vehicle, and then click the HVUT tab to view all tax details related to that truck. In addition to this feature are several other benefits, such as saving information for multiple vehicles at once, avoiding duplicate entries, and easily maintaining and organizing hundreds of vehicles in one space.

In closing, The TruckZone feature in ExpressTruckTax revolutionizes how truck owners and fleet managers organize their fleets and manage their tax filings. This is just one of the many features ExpressTruckTax offers, which is why we remain the #1 IRS-authorized e-file provider! Simplify your taxes and focus on what matters most—running your trucking business.

Create an account now at ExpressTruckTax.com! Have a question? The support team has answers! Contact our support team at 704-234-6005 or support@expresstrucktax.com.