If you haven’t filed your Heavy Vehicle Use Taxes for this year, then you’re running out of time! You have less than a month left to e-file by the due date on August 31.

But before you e-file there are some things you need to know to get started. From your EIN, VIN, and Gross Vehicle Weight to the actual e-filing process, we’ve got you covered!

What You Need Before you E-file

- Your EIN

- Access to Internet

- Computer, Tablet, or Smartphone

- Your VIN

- Your Gross Vehicle Weight

Once you have all that, it’s time to e-file. All you have to do is follow the simple guide below, then you’re all done!

How to E-file

With ExpressTruckTax you can rest assured the e-filing process is incredibly easy. In fact, just follow three simple steps, and you’ll be done in no time!

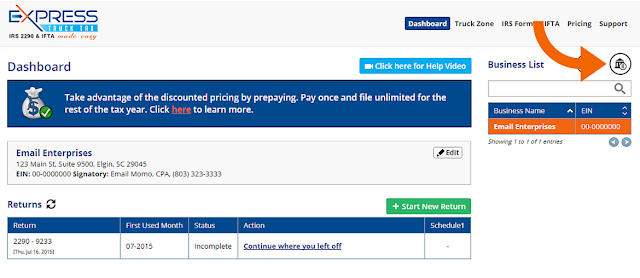

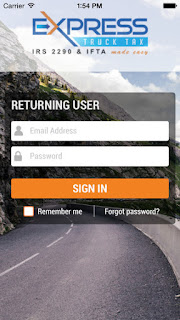

Step 1: Account Setup

- If you’ve created an account with us, simply login to your account.

- If you’ve never created an account with us before, then go ahead and hit “Create Account”, then enter your email address and a password of your choosing to get started.

- Pro-tip #1: To save time, you can also choose to login with your Google account or your Facebook Account.

- Now you need to enter all your business details, including your EIN, business name, and any signing authority you may have.

- Then you can move on and e-file your 2290 for the current tax year.

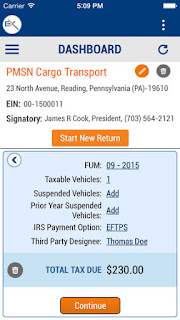

Step 2: Vehicle Details

- Now you need to add all of your vehicle information. If you’re a returning user, you can select the trucks you filed for previously using Truck Zone.

- If you are a new user, you can input your vehicle information one of two ways:

- You can choose to do it manually, entering one truck at a time

- Or you can upload all of your trucks in one fell swoop from a, Excel file.

- And remember, there are three different types of vehicles you can file for. So know the differences!

Step 3: Pay & Securely Transmit

- Now all you need to do is select your payment method and transmit your return!

- Pro-tip #2: The IRS only accepts three payment methods: Direct Debit, EFTPS, and check or money order. They do not accept debit or credit cards.

- After you’ve decided how to pay, review your details on last time and make sure everything is correct. Our system will also review your information for you, just in case.

- Then you can securely transmit your return to the IRS, and get your Stamped Schedule 1 back via email in minutes.

Links to Help You E-file

If you have any questions about other parts of the e-filing process, or how to make sure you’re prepared, we’ve got tons of guides for you to follow! Hopefully we’ve answered every question you could think of to ask, but if you still need help we have an amazing US-Based support team ready and waiting to help you.

Forgot Your Password?

- If you forgot your password, don’t worry! Here is a step-by-step blog on how to recover your password and continuing using your ExpressTruckTax account.

How to Create an Account

- If you’re a new user, this is the guide for you! We go over how to create an account with ExpressTruckTax step-by-step so you can begin e-filing and get back to your life.

FastTransfer Feature

- The FastTransfer feature helps you save time by allowing you to copy your previous return for your current tax year. This guide explains how to utilize the feature in order to e-file.

Truck Zone

- Truck Zone is your very own virtual garage. Store all of your trucks securely on our servers, and never forget a vehicle. This guide explains how this feature benefits you and how to use it.

7 Common E-filing Mistakes to Avoid

- Everybody makes mistakes, but with this guide we’re hoping to minimize several common occurrences. Learn what to avoid and how to successfully e-file for the HVUT tax season.

6 Tips For Success this Renewal Season

- Have a successful renewal season with these 6 easy tips on how to e-file!

The Do’s and Don’ts of E-filing Your 2290

- Tips on how to make e-filing even easier by being prepared throughout the tax year.

If you need any help along the way, just ask our dedicated support legends! You can give them a call at 704.234.6005 during our new extended business hours from 8AM to 8PM EST, or you can shoot them an email at support@expresstrucktax.com for 24/hour support in English and Spanish.

E-file today, avoid late penalties, and get back to your life!

.png)