Unfortunately, taxes can’t be avoided. No matter how fast you run or how hard you fight tax deadlines still slowly creep towards you. The only way to make it out unscathed is to file your return and pay the amount owed to the IRS by the deadline.

Luckily for the Heavy Vehicle Use Tax (HVUT) deadline that’s coming for you on August 31st, ExpressTruckTax provides a quick and convenient e-filing method, so you can file your 2290 hassle free and instantly get your stamped Schedule 1. Check out why ExpressTruckTax is the market leader in the 2290 e-filing industry.

The Benefits Of E-Filing With ExpressTruckTax

ExpressTruckTax saves you time. Instead of having to go wait in a long line at an IRS office, you can quickly e-file online with ExpressTruckTax. Plus, the e-filing process is incredibly easy. All you have to do is follow the step-by step guide to complete your form in just a few minutes and transmit it directly to the IRS.

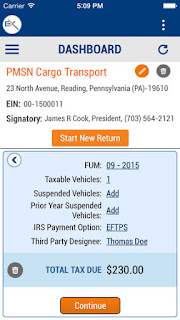

Also, if you filed with us previously then you can copy your information from a previously accepted return to your current one. This way you don’t have to spend time re-entering your information.

With the bulk upload feature, you can quickly upload all of the information for your vehicles at once, helping those with multiple vehicles save time because they won’t have to enter their trucks in one by one. Use the ExpressTruckTax excel template or your own file to upload all of your vehicles at the same time.

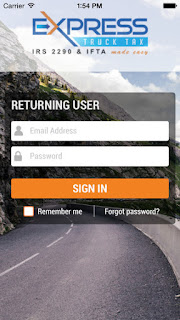

You don’t even need a computer to file. Download the ExpressTruckTax App to file from any location at any time. As long as you have any web based device like a smartphone or tablet, which we’re sure you have since it’s 2017, then you can file from any location. If you’re out on a trip? No problem, handle all of your 2290 needs with the mobile app.

The ExpressTruckTax system is full of helpful hints and tips along the way. If you aren’t sure if you have a suspended vehicle or not, then you can read about what qualifies as a suspended vehicle while filing. By the way, a suspended vehicle is any taxable vehicle that is expected to be used for less than 5,000 miles (7,500 miles for agricultural vehicles) during the tax period.

ExpressTruckTax will get you your 2290 Schedule 1. As soon as the IRS stamps it, you’ll receive a copy via email. However, you can also elect to have your stamped Schedule 1 texted, faxed, or mailed to any location, making it super easy to send it to your carrier.

Your relationship with ExpressTruckTax doesn’t end once you get your stamped Schedule 1 because you can return to your account to access your copy at any time. You can also come back to easily make 2290 amendments and we offer free VIN corrections.

If you want an even easier way to file then contact TSNAmerica at 803.386.0320 because their outstanding team will file your 2290 for you over the phone. The process is as easy as a 10-minute phone call and as a result, you’ll receive a copy of your stamped Schedule 1 via email.