El Formulario 2290 del Impuesto sobre el Uso de Vehículos Pesados (HVUT) se declara anualmente al IRS por parte de los conductores de vehículos que pesan 55,000 libras o más. Hacer el Formulario 2290 con ExpressTruckTax es rápido y fácil porque no solo toma unos minutos, sino que también tiene múltiples opciones convenientes para pagar su impuesto sobre el uso de vehículos pesados al IRS. Una de estas opciones convenientes de pago es hacer el Formulario 2290 y seleccionar pagar con cheque o giro postal. A continuación, encontrará información útil sobre cómo pagar su impuesto sobre el uso de vehículos pesados mediante un cheque o giro postal.

Escribir el cheque

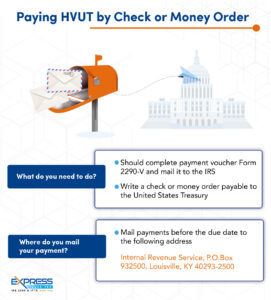

Cuando selecciona cheque o giro postal como método de pago, debe asegurarse de que sea pagado a nombre del “United States Treasury”. Escriba su Número de Identificación de Empleador (EIN), su número de teléfono, año fiscal y el “Formulario 2290” en el cheque o giro postal.

Qué debe incluir

Al seleccionar cheque o giro postal, recibirá un comprobante, 2290-V, que incluirá con su cheque o giro postal. Asegúrese de no engrapar su pago al comprobante. Además, es importante asegurarse de no incluir dinero en efectivo con su pago.

Donde enviar

El comprobante, 2290-V, contendrá la dirección a la que enviará su cheque o giro postal. Esta dirección es la siguiente:

Internal Revenue Service

P.O. Box 932500

Louisville, KY 40293-2500

¿Por qué pagar su HVUT con un cheque o giro postal?

Seleccionar pagar su impuesto sobre el uso de vehículos pesados con cheque o giro postal significa que no tendrá que pagar su impuesto de inmediato si aún no tiene los fondos. Sin embargo, su declaración se considerará a tiempo si se presenta antes de la fecha límite. Cuando el dinero ha sido retirado de su cuenta, ya no tiene que preocuparse por el retraso en su pago.

¿Por qué hacer el Formulario 2290 con ExpressTruckTax?

Presentar el Formulario 2290 es rápido y fácil. Simplemente complete la información necesaria sobre su negocio, su vehículo y los vehículos de crédito que está reclamando, si corresponde. Pagar con cheque o giro postal es solo uno de los varios métodos de pago convenientes aprobados por el IRS que ofrece ExpressTruckTax. Todos estos son simples y fáciles de seguir para asegurar que su Formulario 2290 y su pago del Impuesto sobre el Uso de Vehículos Pesados no se atrasen. ¿Qué está esperando? ¡Haga su ExpressTruckTax ahora para una experiencia de declaración del Formulario 2290 conveniente y rápida hoy!