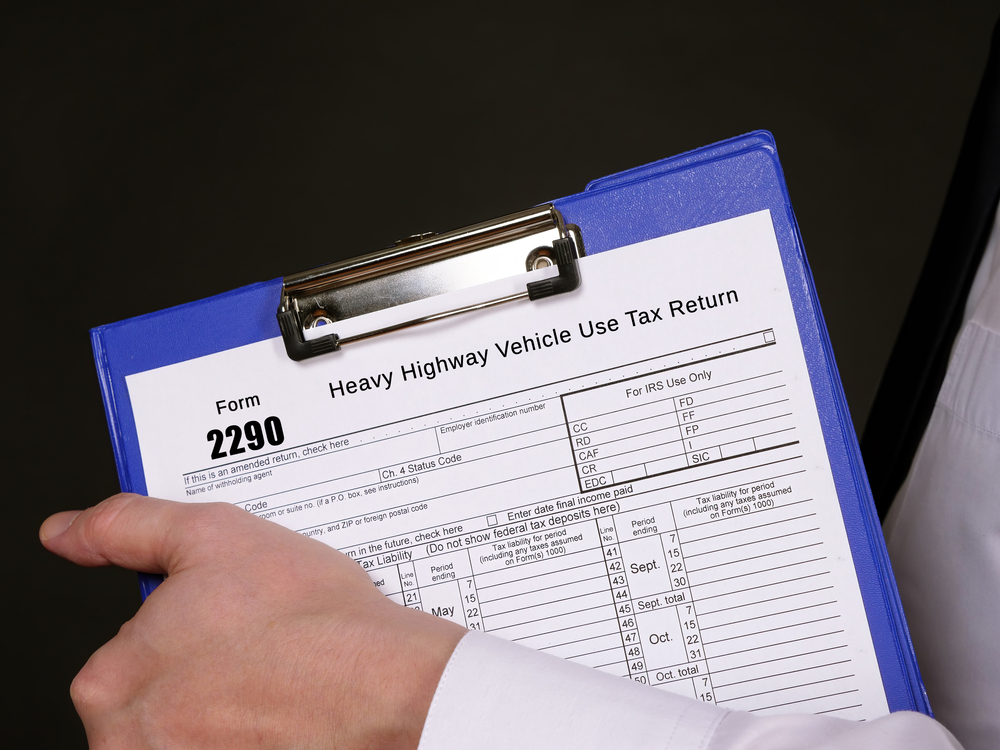

Filing IRS Form 2290 correctly is essential for maintaining compliance and ensuring your heavy vehicles can stay on the road without delays. A rejected Form 2290 can have serious consequences, from halting vehicle registration to incurring costly fines and disruptions to your operations. By understanding the common reasons for rejection and learning how to address them, you can eliminate errors and streamline your filing process.

Accuracy is everything when filing Form 2290. Even small mistakes can trigger rejections, leading to delays and additional administrative burdens. Below are the most common causes of Form 2290 rejections and tips to avoid them.

Incorrect Vehicle Identification Number (VIN)

The Vehicle Identification Number (VIN) is a 17-character alphanumeric code assigned to each vehicle, serving as its unique identifier. This code includes a combination of numbers and letters that provide critical details about the vehicle, such as the manufacturer, model, engine type, and production year. It is used by the IRS to ensure accuracy in identifying vehicles for Heavy Vehicle Use Tax (HVUT) filings.

When submitting IRS Form 2290, even a small typo or error in the VIN—such as a transposed number, omitted digit, or incorrect character—can result in the form being rejected. This discrepancy arises because the IRS cross-references the VIN on the submitted form with their existing records. If the submitted VIN does not exactly match what is recorded, the form is flagged and rejected, delaying the processing of your Schedule 1, which is critical for vehicle registration.

Why VIN Errors Happen

VIN errors often occur due to:

- Manual Entry Mistakes: Entering the VIN by hand increases the likelihood of errors, especially since the combination of letters and numbers can be confusing (e.g., mistaking the letter “O” for the number “0”).

- Incorrect Reference Documents: Using outdated or incorrect vehicle documents when filing can result in submitting an incorrect VIN.

- Data Transfer Errors: When copying VINs from spreadsheets or databases, mistakes may occur during manual transfers.

Solution: How to Avoid VIN Errors

To ensure accuracy and prevent VIN-related rejections:

- Double-Check the VIN Against Official Documents:

Always refer to your vehicle’s registration documents, title, or insurance paperwork when entering the VIN. Avoid relying on memory or informal records. - Use Digital Tools for Accuracy:

Filing platforms like ExpressTruckTax offer a VIN Checker feature, which validates the VIN against the National Highway Traffic Safety Administration (NHTSA) database before submission. This automated tool reduces human error and ensures the correct VIN is entered. - Review Carefully Before Submission:

Take a moment to review the entered VIN thoroughly, character by character, before submitting Form 2290. A simple verification can prevent costly rejections. - Leverage Technology for Bulk Filings:

For fleets filing multiple vehicles, errors can compound quickly. Use ExpressTruckTax’s Bulk Upload feature, which allows VINs to be imported from spreadsheets while minimizing data entry errors. - Know the Correction Process:

If a VIN error does occur, it’s important to correct it promptly. With ExpressTruckTax, you can file a VIN Correction Form quickly and electronically at no additional cost, allowing you to receive an updated Schedule 1 without delays.

Taxpayer Identification Number (TIN) or Employer Identification Number (EIN) Mismatch

The Taxpayer Identification Number (TIN) or Employer Identification Number (EIN) is a unique nine-digit identifier issued by the IRS to businesses for tax purposes. When filing IRS Form 2290, the IRS uses this number to verify the identity of the filer. If the TIN/EIN you provide does not match the IRS records exactly, the form will be rejected.

Why TIN/EIN Mismatches Happen

TIN or EIN mismatches can occur due to several common reasons:

- Incorrect Entry: A simple typo, missing digit, or transposed number during manual entry can result in a mismatch.

- Recent EIN Registration: If you recently obtained an EIN, it might not yet be updated in the IRS database. The IRS recommends waiting up to 15 business days after obtaining a new EIN before filing Form 2290.

- Mismatch in IRS Records: Sometimes, the name associated with your EIN (business name) does not align exactly with IRS records. Even minor discrepancies, such as missing abbreviations or punctuation, can cause a rejection.

- Using the Wrong Number: Confusion between a Social Security Number (SSN) and an EIN can lead to incorrect entries, particularly for small businesses or owner-operators.

Solution: How to Avoid TIN/EIN Mismatches

- Verify Your EIN Before Filing:

- Double-check your EIN against official IRS-issued documentation, such as your EIN Confirmation Letter (CP 575).

- If you are unsure of your EIN, contact the IRS Business and Specialty Tax Line at 800-829-4933 to confirm your details.

- Match the Business Name Exactly:

- Ensure that the name on Form 2290 matches the name associated with your EIN in the IRS records.

- Pay attention to details like punctuation, abbreviations, and spacing. For instance, “ABC Trucking LLC” and “A.B.C. Trucking LLC” may be flagged as mismatches.

- Wait for New EIN Activation:

- If you recently received a new EIN, wait at least 15 business days before filing Form 2290. This allows time for the IRS database to update with your new EIN.

- Use Automated Validation Tools:

Filing platforms like ExpressTruckTax offer TIN/EIN Validation features that cross-check your entered information against IRS records. This tool helps identify discrepancies before submission, reducing the risk of rejection. - Keep Consistent Records:

Maintain accurate records of your EIN, including official IRS letters, prior tax returns, and business registration documents. This ensures you always have the correct information when filing.

Mileage Use Limit Errors

The IRS imposes specific mileage use limits for vehicles subject to the Heavy Vehicle Use Tax (HVUT). Vehicles that exceed these limits are required to file Form 2290 and pay the appropriate tax. For most heavy vehicles, the mileage limit is 5,000 miles per tax year. Agricultural vehicles, such as farm trucks, have a higher limit of 7,500 miles annually. If you underreport, misreport, or inaccurately track mileage, your Form 2290 may be rejected or flagged, leading to delays and potential penalties.

Why Mileage Use Errors Happen

Mileage use errors typically occur due to:

- Inaccurate Record-Keeping: Without consistent mileage tracking, it’s easy to underestimate or misreport mileage during the filing process.

- Confusion About the Limits: Filers may misunderstand the IRS mileage use thresholds, particularly for agricultural vehicles.

- Failure to Update Records: If mileage logs are not updated regularly, the reported usage may not reflect the actual mileage driven.

- Manual Errors: Entering incorrect mileage figures, even by accident, can trigger issues with your IRS submission.

Solution: Accurately Track and Report Mileage

To avoid mileage errors and ensure IRS compliance:

- Implement a Mileage Tracking System:

Use tools like electronic logging devices (ELDs) or digital mileage trackers to monitor mileage accurately. These systems provide real-time mileage data, reducing the risk of underreporting or overreporting. - Maintain Detailed Records:

Keep consistent mileage logs throughout the year. Records should include:- Vehicle identification (VIN)

- Trip dates and routes

- Odometer readings at the start and end of each trip

- Total annual mileage

- Proper documentation not only ensures accurate reporting but also serves as a reference in case of IRS audits or discrepancies.

- Understand the IRS Mileage Limits:

- Regular Vehicles: Vehicles exceeding 5,000 miles annually are subject to HVUT.

- Agricultural Vehicles: Vehicles primarily used for farming can operate up to 7,500 miles annually before tax becomes applicable.

- Ensure you categorize your vehicle correctly and apply the appropriate mileage limits when completing Form 2290.

- Review and Verify Before Filing:

Before submitting Form 2290, cross-check the reported mileage against your logs and tracking tools. A simple review can prevent costly errors and avoid rejection. - Utilize ExpressTruckTax for Accuracy:

Platforms like ExpressTruckTax streamline the mileage reporting process. Features such as automated data entry checks and error detection tools help ensure the mileage you report aligns with IRS requirements. For businesses managing multiple vehicles, ExpressTruckTax’s bulk upload feature simplifies reporting for entire fleets.

Non-Compliance Citations

Unresolved tax obligations from previous periods, such as unpaid Heavy Vehicle Use Tax (HVUT) or penalties, can cause your IRS Form 2290 to be rejected. The IRS closely monitors past filings to ensure compliance, and any outstanding amounts or unresolved issues will prevent successful submission of your current return.

Why Non-Compliance Citations Occur

Non-compliance issues typically arise from:

- Unpaid HVUT From Previous Tax Years: If you failed to pay the required HVUT in prior periods, the IRS will flag your account, and your new filing will be rejected.

- Late or Missed Filings: Not submitting Form 2290 by the IRS deadline can result in penalties and interest, which must be resolved before future filings are accepted.

- Partial Payments: Filing Form 2290 but failing to pay the full HVUT amount due creates a discrepancy in IRS records.

- Penalties and Interest Accumulation: Outstanding penalties or interest from prior rejections or missed payments can accumulate and lead to a non-compliance status.

Solution: How to Resolve Non-Compliance Issues

- Review IRS Notices:

Check any IRS notices or correspondence regarding outstanding tax liabilities, missed filings, or penalties. These notices will outline the specific issues and amounts owed. - Confirm Outstanding Balances:

Use the IRS E-Services for Business or contact the IRS Business Tax Line at 800-829-4933 to confirm the amount owed, including penalties and interest. - Resolve Tax Payments Promptly:

- Pay Outstanding HVUT: Submit any unpaid HVUT amounts for prior tax years immediately to bring your account into compliance.

- Settle Penalties and Interest: Ensure all penalties and accrued interest are resolved to avoid further IRS complications.

- File Missed Returns: If you failed to file Form 2290 for any previous period, submit the necessary forms to rectify the issue.

- Verify Compliance Before Filing:

Before submitting the current year’s Form 2290, verify with the IRS that all prior issues have been resolved and your account is in good standing. - Leverage ExpressTruckTax for Assistance:

Filing platforms like ExpressTruckTax can help you stay compliant by:- Reminding you of upcoming deadlines to prevent missed filings.

- Offering error checks to ensure accuracy before submission.

- Assisting with HVUT payments and tracking prior filings to help you identify any unresolved obligations.

Duplicate Filings

Duplicate filings occur when the same IRS Form 2290 is submitted more than once for the same vehicle and tax period. This often happens when filers don’t receive confirmation of their original submission and assume it didn’t go through. While unintentional, duplicate filings can lead to unnecessary IRS rejections, confusion, and delays in obtaining the stamped Schedule 1, which is critical for vehicle registration.

Why Duplicate Filings Happen

Duplicate filings typically result from:

- Lack of Submission Confirmation: If you don’t receive confirmation or notification from the IRS that your Form 2290 was accepted, you might mistakenly file again.

- System or Internet Issues: Technical glitches during submission may cause uncertainty about whether the form was transmitted successfully.

- Miscommunication in Teams: In larger fleets, multiple people may submit Form 2290 for the same vehicle without coordinating, leading to duplicates.

- Resubmitting After Delays: When there’s a delay in receiving the stamped Schedule 1, filers may believe the first attempt failed and submit again.

Solution: How to Avoid Duplicate Filings

- Confirm Submission Status Before Refiling:

- After submitting Form 2290, check for IRS confirmation emails or notifications.

- If you file through ExpressTruckTax, you’ll receive instant updates on the status of your submission. This includes whether the IRS has accepted or rejected your form.

- Track Your Submission Online:

- Use the IRS’s online portal or your e-filing platform to confirm the status of your submission.

- With ExpressTruckTax, you can easily monitor the filing status in real-time through your account dashboard.

- Coordinate Within Your Team:

- For fleets with multiple team members handling filings, ensure clear communication to avoid duplicate submissions. Use a centralized system to track filings and confirm submissions before refiling.

- Wait for IRS Response:

- If there’s a delay in receiving your stamped Schedule 1, give the IRS time to process your form. Filing again before verifying the status can cause unnecessary rejections.

- Review Payment Records:

- Before refiling, verify whether your payment for the HVUT has already been processed. Duplicate submissions often lead to duplicate payments, which require refunds that take time to resolve.

Correcting Duplicate Filings

If you accidentally submit a duplicate Form 2290:

- Review the Rejection Notice: The IRS will indicate that the form was rejected due to duplication.

- Verify Submission Records: Confirm the details of your original submission, including the vehicle’s VIN, tax year, and tax period.

- Contact Support for Assistance: Platforms like ExpressTruckTax provide dedicated support to resolve filing issues quickly and guide you through any next steps.

If a duplicate payment occurs, the IRS will typically process a refund, but it may take several weeks. You can expedite this process by verifying your records and providing the necessary information to the IRS.

Routing Transit Number (RTN) Rejections

The Routing Transit Number (RTN) is a nine-digit code used by banks to identify the financial institution for processing payments. When you file IRS Form 2290, accurate banking details, including the RTN and your bank account number, are essential for successful payment of the Heavy Vehicle Use Tax (HVUT). Any error in this information—whether it’s a single wrong digit or an outdated RTN—can result in payment failures and subsequent form rejections by the IRS.

Why RTN Rejections Happen

Errors with routing or bank account details typically occur due to:

- Manual Entry Mistakes: Typographical errors, transposed digits, or missing numbers are common when entering banking details manually.

- Outdated Banking Information: If your bank account or routing number has recently changed and you use old information, the payment will fail.

- Incorrect Account Type: Providing a savings account RTN or other incorrect account details when a checking account is required for IRS payments.

- Insufficient Funds: If there aren’t enough funds in the designated account, the IRS will be unable to process the payment, leading to rejection.

- Bank-Specific Issues: Some banks may require specific RTNs for electronic transactions, which differ from those used for checks or ACH payments.

Solution: How to Avoid RTN Rejections

- Double-Check Your Banking Details:

- Verify both the RTN and your bank account number directly with your bank.

- Routing numbers can often be found on the bottom of your checks or through your bank’s online portal.

- Confirm Account Type:

Ensure you are providing the RTN for your checking account, as some banks may have different routing numbers for savings accounts or wire transfers. - Keep Your Bank Information Updated:

If your bank account changes or you open a new account, ensure you update the banking details on file for all tax-related transactions. - Use Technology to Avoid Errors:

Filing platforms like ExpressTruckTax incorporate payment verification tools that prompt you to carefully review your RTN and account details before submission. These features reduce the likelihood of manual errors. - Maintain Sufficient Funds:

Confirm that the designated bank account has adequate funds to cover the HVUT payment to prevent transaction failures. - Consult Your Bank for Verification:

If you’re unsure about your RTN or account details, contact your bank directly to confirm the information required for IRS ACH payments.

Correcting RTN Rejections

If your Form 2290 is rejected due to incorrect RTN or banking details:

- Review the IRS Rejection Notice: Identify the specific reason for the payment failure.

- Verify Your Banking Information: Cross-check your bank account and RTN with your financial institution.

- Correct the Errors: Update your banking details in the form.

- Resubmit Form 2290: With the corrected payment information, refile the form promptly to avoid further delays.

With ExpressTruckTax, correcting RTN errors is quick and simple. Our platform guides you through the process to resubmit your form and ensure payment is processed successfully.

Steps to Correct a Rejected IRS Form 2290

If your Form 2290 is rejected, taking swift action is crucial to avoid further complications. Here’s a step-by-step guide to resolve the issue:

- Understand the Rejection Notice

Review the rejection notice carefully to identify the cause of the issue. - Gather Necessary Documentation

Collect relevant documents such as vehicle registration records, EIN confirmation, and bank statements to verify details. - Correct the Errors

- VIN Errors: Match the VIN with your registration and submit a VIN correction electronically.

- TIN/EIN Mismatches: Verify your EIN with the IRS and resubmit the corrected form.

- Mileage Errors: Update the mileage using accurate records.

- Non-Compliance: Resolve any outstanding tax issues before refiling.

- Duplicate Filings: Confirm with the IRS if no further action is required.

- RTN Rejections: Update your payment details and resubmit the form.

- Conduct a Thorough Review

Before resubmitting, review all details to ensure accuracy and avoid repeated rejections. - Resubmit the Form

Follow the rejection notice instructions and promptly resubmit the corrected form. - Monitor Submission Status

Confirm that the IRS has received and accepted your resubmitted form.

Leverage Technology for Accurate and Efficient Filing

E-filing platforms like ExpressTruckTax are designed to simplify the Form 2290 process, eliminating errors and ensuring smooth compliance. Advanced tools and automated features ensure your filings are accurate and minimize rejection risks.

ExpressTruckTax’s user-friendly interface guides you step-by-step through the filing process, making it quick, accurate, and hassle-free. Plus, with instant notifications and a dedicated U.S.-based support team, you can address any issues promptly and stay compliant.