No more putting it off. The 2020-21 IRS Form 2290 season is officially here.

Beginning today, the IRS is processing 2020-21 Form 2290 returns. That means you need to start renewing your registration today!

The HVUT deadline for most truckers is August 31, 2020. However, you shouldn’t wait that long to file. The IRS will inevitably have delays in service due to demand in August. Check here for the changes in Form 2290 filing for the 2020-21 tax year.

You can get your 2020-21 Form 2290 done today! Go to ExpressTruckTax right now and start e-filing.

Get Started Today with ExpressTruckTax

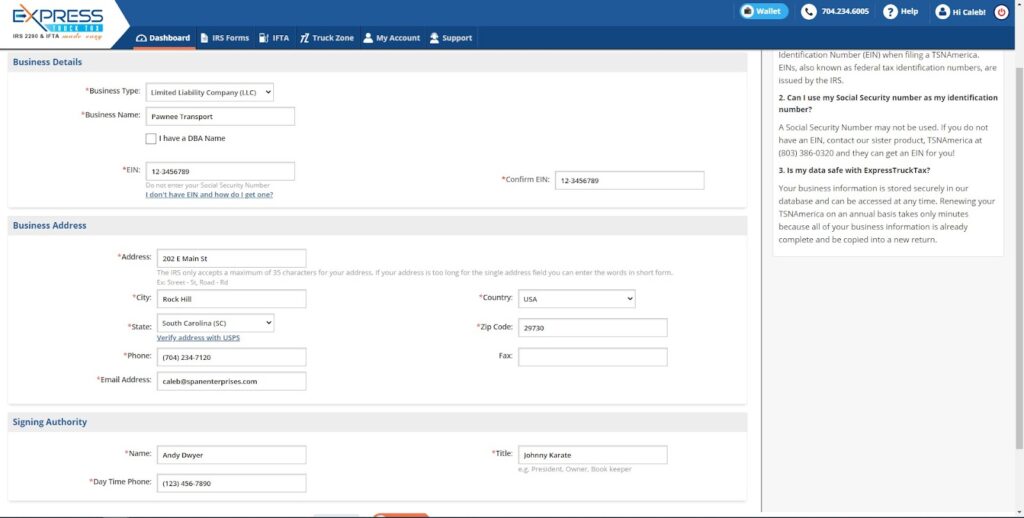

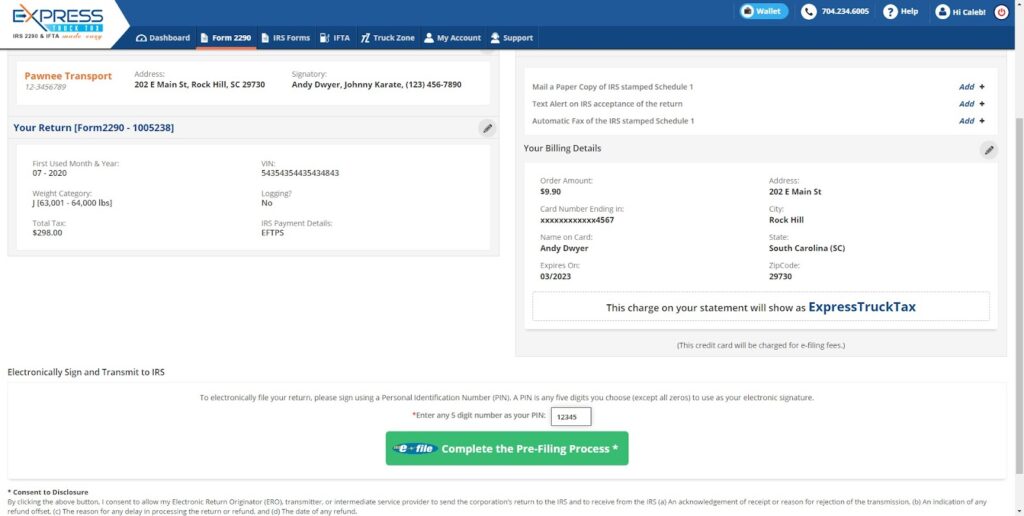

Just follow our simple interview-style e-file process and you’ll get your stamped Schedule 1 back within minutes.

If you have previously filed your Form 2290 with ExpressTruckTax, with the copy return feature your Form 2290 can be transmitted to the IRS in just two simple steps.

Why ExpressTruckTax?

ExpressTruckTax is the market-leading, IRS-authorized e-file provider for the Form 2290. We have processed over $1.5 billion in excise tax payments in the last ten years.

We have served hundreds of thousands of truckers with our simple, secure, and affordable e-filing solution. This year, we’re doing everything we can to simplify taxes for truckers who are sacrificing to keep our shelves stocked. Our customer support representatives are ready to help answer any questions.

We also give you an instant internal audit that checks for common 2290 mistakes. To further ensure accuracy, we offer free VIN corrections should you need them.

Our solution is encrypted and cloud-based so truckers can securely file their Form 2290 on any device, from anywhere, even the cab of their truck. Once complete, returns filed with ExpressTruckTax are transmitted to the IRS instantly, so clients will typically receive their stamped Schedule 1 back in a matter of minutes.

How to Complete and E-file Form 2290 Using ExpressTruckTax?

It takes only 3 steps to complete your Form 2290:

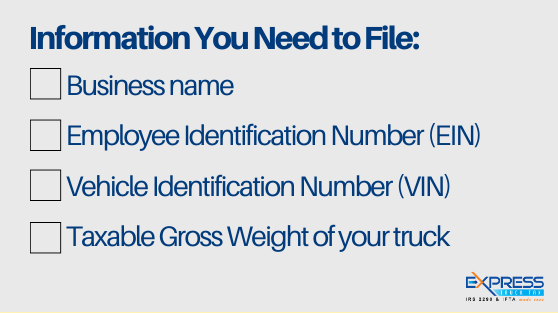

Step 1: Enter Business Information

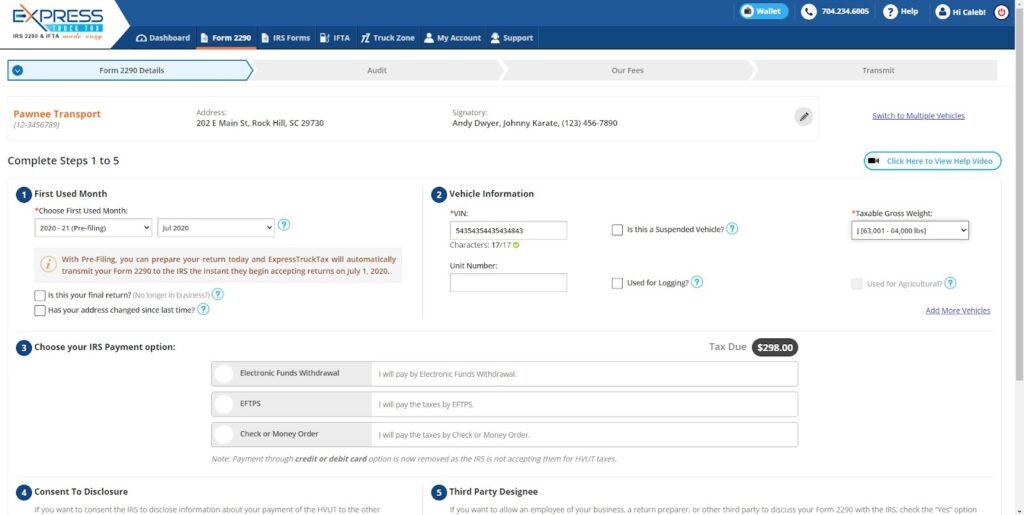

Step 2: Enter Vehicle Information

Step 3: Review Form Summary and E-file

Don’t wait until August to take of your Form 2290. The rush of peak season has begun so get yours finished today!