After you e-file with us the first time, we offer you free VIN corrections just in case you make an error. That way you don’t have to pay another fee to file again just because you may have mixed up two numbers. It’s one of the endless perks we offer our returning users.

However, if you didn’t file with us originally, you can always e-file a Form 2290 Amendment quickly and affordably through ExpressTruckTax.

From start to finish, the whole process of e-filing corrections and amendments through ExpressTruckTax is very easy! Plus, it only takes a few minutes and then it’s right back to your life!

In fact, if you’ve filed with us before, then the amendment process will be very familiar for you. Here’s how to file for VIN corrections of Form 2290 Amendments:

Step 1: Log in or Create an Account

- Once your account is created, or you’ve logged in, click “Start” under Form 2290 Amendments.

- Then select the Amendment you would like to file. For this case, you will choose VIN correction (though we also offer amendments for vehicle weight increase and exceeding the mileage limit).

Step 2: Correction Time

- Select whether you’d like to correct a return you previously e-filed with us, or one filed elsewhere.

- Next enter your vehicle’s first-used month.

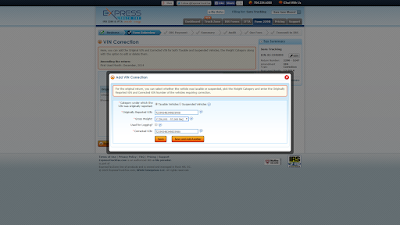

- Select Add VIN Correction, and enter the vehicle’s originally-reported VIN (the one entered incorrectly). Then enter the gross weight, whether the vehicle is taxable or suspended, and lastly enter the new, correct VIN.

- If you need to correct the VIN of more than one vehicle, click “Save and Add Another.” If you only need to correct one, just click “Save” and you’re done!

Step 3: Review and Submit

- Before you submit your information to the IRS, be sure to check for errors one last time. You definitely don’t want to have to file another amendment! Our Instant Audit will also scan your return for gaps and errors.

- Now hit the big green “TRANSMIT” button to securely submit your VIN correction. Now all you have to do is wait for IRS approval!

Once the IRS accepts your correction, you’ll get a shiny new Stamped Schedule 1! Most users receive theirs within 10 minutes of submitting their correction.