Please note that if you obtain a new EIN it takes approximately 10 business days for the EIN to become active within the IRS’ e-file system, thus you should wait until after this period to complete a tax form online.

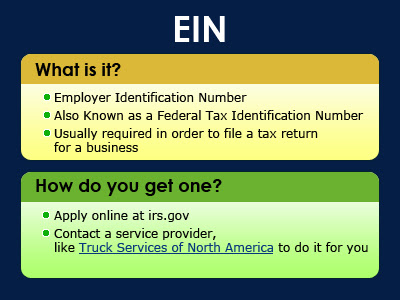

If you are filing Form 2290 for Heavy Vehicle Use Tax (HVUT), you will also need an EIN to file the return. The IRS will no longer accept Social Security Numbers for the Form 2290. It must be an EIN.

The Form 2290 can be E-Filed online through the IRS-Authorized E-File provider ExpressTruckTax.com If you have any questions, you can contact the Truck Tax Team at 704.234.6005